UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2010

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-52815

CODA OCTOPUS GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 34-200-8348 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

4020 Kidron Road, Suite #4, Lakeland, FL 33811

(Address, Including Zip Code of Principal Executive Offices)

(801) 973-9136

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

NONE

Securities registered under Section 12(g) of the Exchange Act:

COMMON STOCK, $0.001 PAR VALUE PER SHARE

| ● | Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X] |

| ● | Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] |

| ● | Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ] |

| ● | Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ] |

| ● | Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. |

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| ● | Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X] |

| ● | State issuer’s revenues for its most recent fiscal year: $19,234,000 (for fiscal year ended October 31, 2015) |

| ● | State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of April 30, 2016, representing the last business day of the registrant’s most recently completed second fiscal quarter: approximately $3,776,015. For purposes of this computation, all directors and executive officers of the registrant are considered to be affiliates of the registrant. This assumption is not to be deemed an admission by the persons that they are affiliates of the registrant. |

| ● | State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 127,078,395 as of August 12, 2016. |

TABLE OF CONTENTS

| 2 |

EXPLANATORY NOTE

This Annual Report on Form 10-K for the year ended October 31, 2010 (the “Form 10-K”) for Coda Octopus Group, Inc. (the “Company”) was due on January 29, 2011. On July 28, 2011, the Company filed a Form 15 (the “Form 15”) with the Securities and Exchange Commission to terminate its registration under the Securities Exchange Act of 1934, as amended, and to suspend its duty to make filings thereunder. The filing of the Form 10-K at this time is not to be deemed an admission by the Company that it was required to do so prior to filing the Form 15.

The consolidated financial statements included herein and the disclosures directly related thereto speak as of October 31, 2010 and 2009, respectively, and for the two fiscal years then ended. Except as the context requires otherwise, all other information in the Form 10-K is current as of the date of filing thereof.

FORWARD-LOOKING STATEMENTS

This Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to in this annual report as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to in this annual report as the Exchange Act. Forward-looking statements are not statements of historical fact but rather reflect our current expectations, estimates and predictions about future results and events. These statements may use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “predict,” “project” and similar expressions as they relate to us or our management. When we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information currently available to us. These forward-looking statements are subject to risks, uncertainties and assumptions, including but not limited to, risks, uncertainties and assumptions discussed in this annual report. Factors that can cause or contribute to these differences include those described under the headings “Risk Factors” and “Management Discussion and Analysis and Plan of Operation.”

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statement you read in this annual report reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. All subsequent written and oral forward-looking statements attributable to us, or individuals acting on our behalf are expressly qualified in their entirety by this paragraph. You should specifically consider the factors identified in this annual report, which would cause actual results to differ before making an investment decision. We are under no duty to update any of the forward-looking statements after the date of this annual report or to conform these statements to actual results.

| 3 |

Overview

Coda Octopus Group, Inc. (“Coda,” “the Company,” or “we”) designs and manufactures patented real time 3D sonar solutions and other leading products for sale to the subsea, defense, mining and marine sciences markets, among others. In addition, we supply marine engineering business services to prime defense contractors.

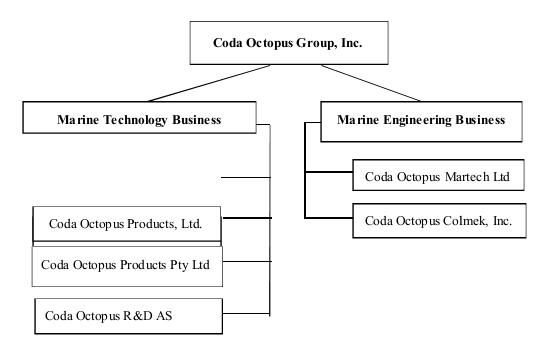

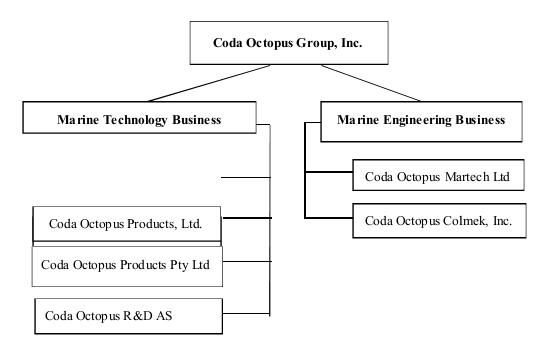

We operate through two operating business segments: Marine Technology Business (“Products” segment) and Marine Engineering Business (“Services” or “Contracting” segment). Our products are used primarily in the underwater construction market, offshore oil and gas and wind energy industry, and in the complex dredging, port security, mining and marine sciences sectors. Our customers include service providers to major oil and gas companies, law enforcement agencies, ports, mining companies, defense companies, universities and research and development institutions.

We supply our marine engineering business services mainly to prime defense contractors. We have been supporting some significant defense programs for over 20 years, including the Close In Weapon Support program that enables us to supply, upgrade and maintain proprietary parts to these programs on an ongoing basis.

Our subsea marine technology products sold through our three wholly owned subsidiaries, Coda Octopus Products, Inc. (USA.), Coda Octopus Products Limited (United Kingdom), and Coda Octopus Products Pty Limited (Australia) and through our appointed agents globally. Our marine engineering business services are provided through our wholly owned subsidiaries, Coda Octopus Colmek, Inc. (“Colmek”) based in Salt Lake City, Utah, and Coda Octopus Martech Limited (“Martech”) based in the United Kingdom.

Our corporate structure is as follows:

Corporate History

The Company began as Coda Technologies Ltd (now operating under the name of Coda Octopus Products Limited), a UK corporation which was formed in 1994 as a start-up company with its origins as a research group at Herriot-Watt University, Edinburgh, Scotland. Initially, its operations consisted primarily of developing software for subsea mapping and visualization using sidescan sonar, a technology widely used in commercial offshore geophysical survey and naval mine-hunting to detect objects on, and textures of, the surface of the seabed.

| 4 |

In June 2002, we acquired by way of a merger Octopus Marine Systems Ltd, a UK corporation, and changed our name from Coda Technologies Ltd to Coda Octopus Ltd. At the time of its acquisition, Octopus Marine Systems was producing geophysical products broadly similar to those of Coda, but targeted at the less sophisticated, easy-to-use, “work-horse” market. It was also finalizing the development of a new motion sensing device (the “F180”), which was to be employed aboard vessels conducting underwater surveys to correct sonar measurement by providing precise positioning and compensation for vessel motion.

In December 2002, Coda Octopus Ltd acquired OmniTech AS, a Norwegian company, which became a wholly-owned subsidiary of the Company and now operates under the name Coda Octopus R&D AS. Before we acquired OmniTech, it had been engaged for over ten years in developing revolutionary sonar imaging and visualization technology to produce three-dimensional underwater images for use in the subsea construction industry. Now marketed by ourselves under the product name “Echoscope®”, this technology is unique in that it generates real time 3D images in low or zero visibility conditions. This technology has been patented in a number of jurisdictions, including the USA. This technology, which continues to be developed by our Research and Development team in the UK and Norway, allowed the Company to start to expand the original focus on hydrographic and geophysical survey to include the high end sonar market. At the inception of the Marine Technology Business our revenues were generated solely from our geophysical software product. Thereafter, we added the F180 series in 2002 and our revenues were split over these two products. With the addition of our real time 3D products, our revenues are now mainly generated from this suite of products and associated services.

On July 13, 2004, pursuant to the terms of a share exchange agreement between The Panda Project, Inc., a Florida corporation, and a now defunct entity affiliated with Coda Octopus Ltd. (“Coda Parent”), Panda acquired the shares of Coda Octopus Limited, a UK corporation and wholly-owned subsidiary of Coda Parent, in consideration for the issuance of a total of 20,050,000 shares of common stock to Coda Parent and other shareholders of Coda Octopus Limited. The shares issued represented approximately 90.9% of the issued and outstanding shares of Panda. The share exchange was accounted for as a reverse acquisition of Panda by Coda. Subsequently, Panda was reincorporated in Delaware and changed its name to Coda Octopus Group, Inc.

In June 2006, we acquired a design and engineering company, Martech Systems (Weymouth) Ltd (“Martech”), which provides bespoke engineering solutions in the fields of electronic data acquisition, transmission and recording, and which has links into our existing markets. Martech are suppliers to prime defense engineering companies. Martech has changed its name to Coda Octopus Martech Limited in December 2008.

In April 2007, we acquired Colmek (then Miller & Hilton d/b/a Colmek), a custom engineering service provider of defense engineering to prime contractors. Colmek has been supporting a number of defense programs since the early 1990’s. Specifically, it supplies proprietary parts into these programs including providing upgrades to such parts to address either obsolescence issues or advancement in technology. This Company changed its name to Coda Octopus Colmek Inc. in December 2008.

Marine Technology Business (“Products Segment”)

Our Marine Technology Business sells proprietary marine products in a number of worldwide market segments:

| ● | Commercial marine geophysical survey; | |

| ● | Oil & gas; | |

| ● | Energy & renewables; | |

| ● | Underwater security, law enforcement and naval operations; | |

| ● | Underwater construction (asset placements, block placements, mattress placement, cable and pipe lay inspection and the like); | |

| ● | Environmental Applications (example mammal research; natural gas seeps; habitat assessment; fisheries); and | |

| ● | Salvage and decommissioning. |

In the commercial marine geophysical survey sector, our products include geophysical data acquisition systems, analysis software and motion detection equipment that are used primarily by survey companies, research institutions and salvage companies.

We believe we possess an important and unique sonar technology, which is patented, and which gives us a significant advantage over our competitors in the market sectors where real time visualization is key and/or low or zero visibility conditions prevail.

Our product range includes products based on our patented Echoscope® in combination with our proprietary software which also includes patented techniques for rendering and tracking. We believe that our products are revolutionizing the sonar market, particularly in real time data acquisition, and subsea visualization in low or zero visibility conditions. This patented technology is the result of more than 20 years of research and development by our subsidiary, Coda Octopus R&D AS (CORDAS), Norway, which we acquired in 2002, and our software development team based in the UK. Our R&D Team in Norway is focused on the hardware component of our technology whereas our R&D Team in Edinburgh is focused on the accompanying software for this technology.

| 5 |

Since the acquisition of CORDAS, we have significantly advanced our research and development with respect to both hardware and software components, filed further patents and brought to market our third generation of the Echoscope® and the CodaOctopus Underwater Inspection System (UIS) as well as new derivative products, such as our forward looking sonar, Dimension® and our Echoscope C500 (a smaller and lighter variant of the Echoscope®).

We are focusing our research and development resources and budget on developing our 4th generation of real time 3D solutions for various market applications and varying price points. We believe this strategy will help to standardize real time 3D solutions in the subsea market and expand the applications for which the technology is used.

We have also introduced to the market the capabilities of real time 3D sonars. This technology is being adopted for many oil & gas, energy, subsea asset placements (blocks, mattresses and other installations), decommissioning and leak identification projects. Most of these projects require real time volumetric visualization.

A series of trials by independent experts and operators in the marine / subsea market have validated our longstanding position that the Echoscope® performance exceeds that of the current standard industry tools (such as the multi-beam sonar) in a number of key applications and provides unparalleled image resolution and beam density. We believe that these capabilities combined with our unique real time visualization advantage, our volumetric data acquisition capability and ability to measure things in real time combined with the further technological advances currently being developed, place the Echoscope® in a position to become the sonar of choice for many underwater applications in the future.

Moreover, many users in complex operations such as underwater construction are reporting significant time savings, and health and safety benefits, which allow them to out-perform their competitors. We believe that our real time 3D solutions including the Echoscope®, which is being referred to by one of our significant customers as “[their] underwater eyes”, are making progress in shifting the conservative approach of the sonar market. Our technology is also used for bespoke and complex underwater construction that requires real time visualization. We believe that our real time 3D solutions are now being viewed as the products of choice in many complex operations. We further believe that our next generation of the real time 3D solutions will become the tools of choice for a much greater number of underwater applications through improved efficiency in work flow process presented by real time visualization capabilities.

We believe that our patented technology is the only commercially available sonar that can provide true real-time 3D volumetric imaging data underwater even in the most challenging zero visibility conditions. This unique capability provides unparalleled underwater scene awareness in similarly high frame rates as cameras and without the reliance of complex and costly positioning and motion reference units or the need for costly post processing of the underwater data acquired. The resultant scene data can be used for multiple tasks simultaneously including object detection and avoidance in true 3D, complex scene mapping and augmented reality 3D workspace imaging combining the real-time 3D data with 3D models, together providing real-time decision making and assessment.

The Echoscope® has a wide range of applications including:

| ● | inspection of harbor walls; | |

| ● | inspection of ship hulls; | |

| ● | inspection of bridge pilings; | |

| ● | block placements (in the context of breakwater construction) | |

| ● | subsea asset placements including landings | |

| ● | deep sea mining | |

| ● | cable laying, cable pull in operations | |

| ● | inspection of offshore installations such as gas and oil rigs and wind turbines; | |

| ● | Remotely Operated Vehicle (ROV) navigation (obstacle avoidance); | |

| ● | Autonomous Underwater Vehicle (AUV) navigation and target recognition (obstacle avoidance); | |

| ● | construction - pipeline touchdown placement and inspection; | |

| ● | obstacle avoidance navigation; | |

| ● | bathymetry (measurement of water depth to create 3D terrain models); | |

| ● | managing underwater construction tasks; | |

| ● | underwater intruder detection; |

| 6 |

| ● | dredging and rock dumping; | |

| ● | contraband detection; | |

| ● | locating and identifying objects undersea, including mines; | |

| ● | detection and study of individual species in real time 3D (fish, whales etc.); | |

| ● | oil and gas leak detection; | |

| ● | fish school detection and analysis; | |

| ● | diver tracking and guidance; | |

| ● | underwater archaeological and salvage site mapping; | |

| ● | decommissioning; | |

| ● | offshore renewable energy – cable laying and burial and pull-in; | |

| ● | marine salvage operations; | |

| ● | harbor construction – concrete armoring; and | |

| ● | unexploded ordinances survey and intervention. |

Within these applications, the technology can essentially provide real time 3D visualization of static scenes or moving objects from either a static location or a dynamically moving platform (vessel, Autonomous Underwater Vehicle (“AUV”) or Remotely Operated Vehicle (“ROV”)). Conventional sonars are capable of producing maps of static scenes only.

The Echoscope® technology is protected by patents, including a number of complementary patents such as a patent which covers our visualization methodology and our rendering of our real time 3D images. For example, one of our recently awarded patents provides for a new method of using multiple sonar images to produce in real-time 3D a very detailed image with sharply defined edges while intelligently discarding “noise” in the image produced by (for example) passing fish or floating debris.

We market the Echoscope® both as a stand-alone sonar device and as a fully integrated system, marketed under the name “CodaOctopus UIS (Underwater Inspection System)”. The latter is specifically aimed at the port security market and has been adopted by a significant number of ports in the United States. Until recently, we have not had any success with foreign ports for this product. In 2015 we have had success in introducing the system in one East Asian port where it is now on a program of adoption and where it will be used for amongst other applications, salvage and port and harbor inspection.

Due to the price point for our real time 3D solutions, we offer these for rent. The equipment is typically supplied with Echoscope® engineering (operator) services. This rental offering is an increasing and important market for the business and also provides access to the technology to a broader range of users.

Products

Our products are marketed under the “CodaOctopus” brand and consist of three main product lines:

Real Time 3D Sonar includes our unique and patented real time 3D sonars and cutting edge software (including patented techniques for rendering and tracking algorithms) that we believe is shaping the future of subsea operations.

Data Acquisition Products includes integrated hardware acquisition devices that feature rich post-processing software for all levels of geophysical survey work

Motion Sensing Products consists of a range of GPS-aided precision attitude and positioning systems and post-processing software for all types of marine survey and positioning work.

Real Time 3D Sonar

We offer four products within the real time 3D sonar: the Echoscope®, the Echoscope® C500 (launched in 2014), the Dimension® and the CodaOctopus Underwater Inspections System.

| 7 |

Echoscope®

We believe that our real-time 3D imaging sonar technology represents the Company’s most promising area for growth in the medium term. Echoscope®, developed over a period of more than 20 years, is a unique, patented technology generating high resolution 3D images of the underwater environment in low or zero visibility conditions in real time. For each sonar ping that is emitted by the Echoscope®, it receives 16,384 pieces of information back. The competition’s multibeam sonar system receives back approximately 256 pieces of information for each sonar ping. This means in real time the probability of finding an underwater target/object is substantially greater with the Echoscope® than the conventional sonar equipment (such as multibeam or other imaging sonars).

Our current Echoscope® is approximately 15x11.8x6.3 inches and connects to a laptop with gaming specifications or similar hardware configuration which is required to handle the volume of data generated by our sonar.

We are unaware of any other product with the capabilities of the Echoscope®. The heightened awareness of terrorist attacks over the last two decades has resulted in a demand for practical, effective and rapid methods of detecting potential threats (such as explosives in harbors or on ship hulls). We believe that our real time 3D solutions including the Echoscope® are ideally suited for this task, as it provides highly detailed 3D images in real time including in difficult sea conditions where there is low or zero visibility.

The Echoscope® systems will sometimes require additional equipment to form a complete solution allowing us to leverage existing products and services, such as motion sensors and imaging processing software, into a wider market, and this in turn offers further opportunity for other products from the portfolio, such as our F180® positioning systems (Motion Sensing Product), discussed below.

Our Software development capability is an important part of the success we have achieved to date with our real time 3D solutions and our strategy to maintain our lead in designing, manufacturing and selling real time 3D solutions. Our real time 3D solutions are sold with Coda Octopus proprietary top end software, Underwater Survey Explorer” (“USE”), and Vantage or Construction Monitoring System (“CMS). Our Software Package is feature rich and includes significant capabilities that are designed to address subsea challenges by application particularly in the context of a dynamic subsea setting (as opposed to a static mapping of the seabed as is typical for conventional sonar technology). Some of our unique features include:

| Feature Description | Functionality | |

| Real Time Measurements | important for many types of subsea operations such as block or asset placements or aiding diving operations; | |

| Models + Software Module | allows the user to import existing models and engineering drawings into the real time subsea environment | |

| Edge Detection Algorithm | allows the user to superimpose an edge to easily identify a subsea target | |

| Rendering a Noise Free Image | allows for a crisp, clear and high resolution photo-like image without any processing (which would be required for conventional sonars) | |

| Tracking Algorithm | Algorithm is used to track known objects within the real time 3D Data. This is currently utilized in our Construction Monitoring Software Package (see below) |

The Echoscope® and CodaOctopus Construction Monitoring Software (CMS) Software have important applications for breakwater construction. Our CMS package has been recently updated to include patented algorithms for tracking and placement of the single layer armor blocks used in a breakwater construction.

The CodaOctopus solution is one of two preferred solutions for breakwater construction and increasingly the CodaOctopus’ solution is becoming the preferred solution for subsea block placements in breakwater solutions because of the capabilities that allow the crane operator to visualize the blocks while they are being placed in real-time. The CodaOctopus solution has significantly simplified and made safer this area of the workflow process in breakwater construction.

We do not believe that this important capability along with real-time visualization and monitoring of the construction site including previously laid blocks is possible with competing solutions. In addition, the feature rich software package (CMS) which allows the complete workflow for breakwater construction to be planned within the software, greatly reduces risks and time to the project and improves the quality of project deliverables and progress throughout. The patented tracking algorithms that have recently been enhanced and strengthened allow onward opportunity for similar applications involving placing known objects or structures underwater for other applications as well.

| 8 |

Dimension®

Designed for the remotely operated underwater vehicle (“ROV”) market, the Dimension® real time 3D forward looking sonar with CodaOctopus Vantage software (“Vantage”) offers a step-change view to ROV pilots. With a user-selectable quad-view of the scene in front of the ROV, the pilot can maneuver, navigate and monitor with confidence during zero visibility conditions.

Based on our patented Echoscope® technology and our Vantage software, Dimension® provides unparalleled real-time visualization for subsea vehicle applications. Designed for a wide range of ROVs, Dimension® is a unique, true real-time 3D sonar that transforms ROV underwater operations.

Using the Vantage software suite and advanced beam forming techniques, the Dimension® sonar provides the ROV pilot with a unique quad-view for safe navigation and obstacle avoidance purposes. The Vantage quad-view features a conventional plan-view, commonly provided by scanning sonars, along with three additional and separate real-time perspectives of the subsea environment.

Echoscope® C500 (“C500”)

The C500 was launched in 2014 and is based on our patented Echoscope® technology and delivers real-time 3D sonar capability in a smaller, lighter, ruggedized form factor with reduced power requirements. It is suitable for ROV and autonomous underwater vehicle (“AUV”) based applications as well as vessel deployments.

Fully integrated with our powerful Underwater Survey Explorer software, the C500 can be used with the full range of functionality available including the latest Models+ software module allowing dynamic control of sonar with augmented 3D models in the 3D Workspace. The C500 allows the acquisition of full real-time 3D data in a time efficient manner.

As a result of the reduced form factor, reduced power consumption requirements and price point, this new product opens new markets for our real time 3D solutions.

Software Products

All our sonars are sold with one of three proprietary software applications, Underwater Survey Explorer, Vantage or our Construction Monitoring System (CMS). Our Software packages are critical to the usability of our real time 3D sonar solutions. Our software applications are feature rich and are uniquely driven to provide complete functionality in the live environment without the need to perform post processing and analysis of the data to produce results. There are a number of unique capabilities (some of which are described above).

Data Acquisition

We started our business in 1994 designing and developing the CodaOctopus GeoSurvey software package. For over a decade our GeoSurvey™ has been an industry leading software package on the market for data acquisition and interpretation and provides feature rich solutions and productivity enhancing tools for the most exacting survey requirements. Designed specifically for side-scan and sub-bottom data acquisition, CodaOctopus GeoSurvey has been purchased by numerous leading survey companies throughout the world. This product range includes:

CodaOctopus GeoSurvey Acquisition Products

These consist of a range of hardware and software solutions for field acquisition of sidescan sonar and sub-bottom profiler, which includes analogue and digital interfaces compatible with all geophysical survey systems. This is our original product range that includes the following products:

DA4G - 500, Sidescan sonar and sub-bottom profiler simultaneously

DA4G - 1000, Sidescan sonar and sub-bottom profiler separately

DA4G - 2000, Sidescan sonar or sub-bottom profiler

CodaOctopus GeoSurvey Productivity Suite

This consists of an integrated suite of software that automates the tasks of analyzing, annotating and mosaicing complex data sets, thus ensuring faster and more precise results.

| 9 |

CodaOctopus Instruments

These consist of simple, solid and robust solutions for sidescan sonar and sub-bottom profilers. Used throughout the world by leading survey companies, navies and academic organizations, CodaOctopus instruments are ideal where minimal training and simple installation and set-up is paramount. Coupled with intuitive but powerful post processing software, the Octopus range meets the requirements of survey applications from the smallest inshore survey, rapid deployment naval reconnaissance to large scale site investigations. This product range includes the following:

The DA4G™ series of acquisition systems which provide high quality, robust and reliable data acquisition from the latest digital and analogue sidescan sonar and sub-bottom profiler sensors.

DA4G™ is the 4th generation of our successful DA series and is built on twenty years of knowledge, experience and innovation in supplying unparalleled products and service to the worldwide geophysical survey sector. These purpose-built, turn-key, systems incorporate the very latest hardware specifications and are designed and delivered to meet the demanding nature of offshore survey work.

The DA4GTM range consists of a number of options and is backed up (like all our products) with global service and support.

Motion Sensing Products

The CodaOctopus F180® and the more recently introduced CodaOctopus F170TM families have been developed for the marine environment based on technology originally developed for the extreme world of motor racing. Modifications and enhancements have resulted in a simple-to-use, off-the-shelf product that brings accurate positioning and motion data into extreme offshore conditions for precision marine survey applications worldwide. Variants within the F180® series include the F190™, exclusively configured for use ‘inland’, e.g. within ports and harbors, and the F185™, with enhanced precision positioning to 2 cm accuracy (<1”). Octopus iHeave, an intelligent software product for dealing with long period ocean swell compensation, is fully integrated within the F180® series.

The F170™ family is designed with ease of use in mind. They are compact, simple to install and produce accurate position and motion data for the marine industry. Two product variants are available: the F170™ and the F175™. The F175™ allows integration of third-party GNSS systems thus enhancing the accuracy of the outputs and improving the robustness of the solution.

This product is sold alone and in conjunction with our real time 3D sonars. We are currently expending a significant amount of our resources in developing the new generation of our motion sensors. Our newly developed suite of products will focus on expanding the market into which we sell these devices to include the AUV market which is an expanding market for our products in general.

Coda Octopus Products Limited has the requisite accreditation for its business including LRQ accredited to ISO 9001:2008.

Marine Engineering Businesses (“Service Segment”)

Our Marine Engineering Businesses (Coda Octopus Martech Limited (based in Portland, Dorset, England) and Coda Octopus Colmek, Inc. (based in Salt Lake City, Utah)) operate in the defense space.

We provide engineering services to a wide variety of clients in the defense markets. A significant part of these services are provided to defense contractors and are often intended for prototype productions which typically lead to long term manufacturing contracts. These arrangements often give us preferred/sole supplier status for long term manufacturing contracts, tech refresh and the obsolescence management for such customers. Our engineering capabilities are increasingly being combined with our product offerings, bringing opportunities to provide complete systems, installation and support.

Coda Octopus Martech Limited (“Martech”)

Martech operates in the specialized niche of bespoke and manufacturing services mainly to the United Kingdom defense and subsea industries. Its services are provided on a custom sub-contract basis where high quality and high integrity devices are required in small quantities. Martech has the requisite accreditation for its business including LRQ accredited to ISO 9001:2008.

An example of Martech’s design and engineering services is the development of a ruggedized display unit in military vehicles capable of displaying variables such as wind speed, air temperature and humidity independent of the vehicle’s computer.

In late 2010 Martech was awarded a significant contract to design and build two pre-production decontamination units the successors of which have been designated as part of the ground equipment for a major international military aircraft program.

| 10 |

The Company enjoys pre-approvals to allow it to be short-listed for certain types of government contracts. Much of the more significant business secured by Martech is through the formal government or government contractor tendering process.

Martech is a key supplier of various parts of our marine products business and has been assisting in the further development of a number of those products.

On or around October 18, 2010 our subsidiary, Coda Octopus Martech, entered into an arrangement (Company Voluntary Arrangement or (“CVA”)) under which it was agreed to re-schedule £503,335 an equivalent of $807,000 (using an exchange rate of 1.6035) amounts to trade creditors. Under the CVA this amount was scheduled to be repaid over 4 years.

During the fiscal year 2015 Martech moved into new modern facilities comprising both office, manufacturing and research and development units. These premises are leased from its sister company, Coda Octopus Products Limited. Martech also supplies the latter business with manufacturing capacity for some of its products.

Coda Octopus Colmek, Inc. (“Colmek”)

Colmek is a service provider of defense engineering solutions, particularly in the fields of data acquisition, storage, transmission and display.

It has grown and diversified since beginning its operations in 1977 and now provides services and products to a wide range of defense, research and exploration organizations in the United States.

Colmek designs, manufactures and supports systems that are reliable and effective in multiple military and commercial applications where ruggedness and reliability under extreme operational conditions are paramount and where lives depend on accurate and precise information.

Colmek has the requisite accreditation for its business including LRQ accredited to ISO 9001:2008.

Colmek has long standing relationships with a number of prime defense contractors and has been supporting a number of defense programs for over 15 years including the (CIW) Close In Weapons Support Program (Phalanx) for which it supplies proprietary parts and services and technical refresh programs for these parts. As a result, Colmek has repeat revenues from these long standing programs.

Colmek continues to expand the number of established programs it supplies proprietary parts to. In June 2014 Colmek completed the acquisition of the Thermite® Rugged Visual computer line and the Sentiris AV1 XMC video card from Quantum 3D for a cash consideration of $1,100,000. Colmek also acquired hardware and other intellectual property rights (such as, software code and trademarks pertaining to these products).

The Thermite® Product fits within established programs with Department of Defense (“DoD”) prime contractors and benefits from being a single source product under this program. Customers for this item include US Army, Benchmark, and iRobot’s Defense and Security Division and since acquiring this product in 2014 it has yielded revenues of approximately $1,500,000. The Sentiris product has recently completed its first article inspection and is being developed for a DoD prime contractor.

Thermite® Rugged Visual Computers

| ● | Rugged, graphics-based PCs designed to perform in the most brutal environmental conditions | |

| ● | Focus on graphics-based high-performance computing with integrated accelerated video capture capability | |

| ● | Lightweight, power efficient, conduction-cooled | |

| ● | Three models, optimized for man-wearable, vehicle, and airborne platforms | |

| ● | Programs include dismounted soldier training, mission rehearsal, real-time imaging, robotic control, weapon system control, C4ISR, sensor processing and display |

Sentiris AV1 XMC

| ● | FPGA-based PCI Express Mezzanine Card designed for video and graphics processing applications | |

| ● | Targeted platforms include MH-47G helicopters, MH-60M Blackhawk helicopters, MC-130H Combat Talon II and CV-22 Tilt-Rotor aircraft |

| 11 |

Stinger™ family of Rugged Small-Form-Factor PCs

The Stinger 1000 is a unique rugged computer that provides a cost effective solution for harsh mobile computing environments. Utilizing PC-104 architecture and employing creative ruggedization, Colmek has engineered a stable platform which is easily tailored to any application.

The Stinger 1000 rugged mobile computer is highly customizable, presenting an inspiring assortment of selectable attributes. The stinger mobile computer is engineered to meet military requirements. Colmek has successfully deployed Stinger products on Unmanned Aerial Systems (UAS), and shipboard for satellite-based tracking systems.

RhinoTuff™ family of Rugged Touch Screen Computers

The robust RhinoTuff™ rugged touch screen computer is built exclusively for reliable operation in the world’s harshest environments. It is modular and user-definable affording maximum flexibility. This all-weather, all terrain, all-in-one PC thrives in a field where the average “tough” computer is simply not tough enough, including, mining and construction sites, oil fields, marine environments, and military battlefields.

Rugged Chassis/Enclosures

The chassis and enclosures offered by Coda Octopus Colmek are fully customizable to military/industrial needs. Colmek is a key supplier on high profile programs including Raytheon’s Phalanx Close-In Weapons System (CIWS) and Northrop Grumman’s airborne mine hunting sonar AN/AQS-24. We also offer a variety of enclosures technologies.

Other products offered by Colmek include subsea telemetry & data acquisition systems, rugged workstations, analog-to-digital converters and rugged LCD displays.

Sales and Marketing

We conduct worldwide sales and marketing through each company individually, with our synergies, national and international exposure sought under the management of the heads of each operation. This structure provides dedicated sales effort in each of the Group companies, and encourages cross-selling and marketing of other Group companies’ products and services. Generally, our focus is on widening our market reach and on selling broader services, systems and solutions within our existing customer base.

Our marketing effort is dedicated to enhancing, reinforcing, and protecting the value of our lead in this emerging market, broadening our current product and systems-based offerings to be able to offer complete solutions. However, within that we have the following supporting marketing sub-strategies:

Product: Build on the significant lead that we have in the market for cutting edge real time 3D solutions by designing and developing the next generation of real time underwater 3D solutions in a superior form to our existing products and thereby open new markets for these solutions by having superior price, performance and customer utility at the forefront of our strategies.

Place: The use of strategic partnerships, at the higher value end of the market, particularly to provide solutions rather than product (e.g. the provision, through partnership, of a complete port security solution to a major port), and the use of existing and new sales agents to provide sales leads for lower value but very important “pure” product sales. We also work with carefully selected agents who through their local relationships or capabilities are able to market and promote our products and assist us in opening new markets for our real time 3D solutions.

Promotion: The attendance and illustration of our capabilities at trade shows, use of customer mailing, advertising and trade public relations.

| 12 |

Competition

Data Acquisition Products

The sonar equipment industry is fragmented with several companies occupying niche areas, and we face competition from different companies with respect to our different products. In the field of geophysical products Triton Imaging Inc., a US-based company, now part of the ECA Group (Toulon, France), Chesapeake, a US-based company, and Oceanic Imaging Consultants, Hawaii, USA, dominate the market with an estimated of 25% each of world sales, while we believe that we control approximately 10% of world-wide sales.

Motion Sensing Products

In the field of motion sensing equipment, where our product addresses a small part of the overall market, we believe that we have four principal competitors: TSS (International) Ltd in Watford, England which is focused on the mid-performance segments with about 25% of the world market; Ixsea, a French company which covers all segments, with about 20% of the market; Kongsberg Seatex, a Norwegian company (part of Kongsberg Gruppen) which has products across all segments, with about 15% of the market; and Applanix, a Canadian company, now part of Trimble which has one major product focused on the high end of the market, with about 20% of the market. We believe that our market share in the field of motion sensing equipment is only about 10%.

Real Time 3D Sonar

In the field of Real Time 3D imaging, we are unaware of other companies offering a similar product. The entry into this market is dependent upon specialized marine electronics and acoustic skills. The learning curve, which has resulted in the advancement of our real time 3D sonar device, is the culmination of two decades of research and development into this field. We are also aware of a number of high profile and substantial competitors’ real time 3D projects that have failed. Over the last several years there have been lower grade sonars entering the market of 3D imaging. Companies such as Tritech International Ltd., United Kingdom, and BlueView Technologies Inc., USA (now a part of Teledyne), are examples, but none of these sonar offerings are direct comparisons or competitors in respect of our real time 3D solutions as we believe that they do not have the same capabilities as our patented Echoscope® technology in terms of generating real time 3D images of submerged objects and environments in low or zero visibility conditions.

We seek to compete on the basis of producing high quality products employing cutting edge technology that is easy to use by operators without specialized skills in sonar technology. We intend to continue our research and development activities to continually improve our products, seek new applications for our existing products and to develop new innovative products.

Marine Engineering Businesses

Through our marine engineering operations, Coda Octopus Colmek, Inc. and Coda Octopus Martech Limited, we are involved in custom engineering for the defense industry in the United States, and in the United Kingdom. Martech competes with larger contractors in the defense industry. Typical among these are Ultra Electronics, BAE Systems, and Thales, all of whom are also partners on various projects. In addition, the strongest competitors are often the clients themselves. Because of their size, they often have the option to proceed with a project in-house instead of outsourcing to a sub-contractor like Martech or Colmek.

Intellectual Property

Our product portfolio and technologies are protected by intellectual property rights including trademarks, copyrights and patents. We have a number of fundamental patents including a patent covering the stitching together of acoustic imagery. This covers the real time acoustic image generation element of what we do, and we believe it provides us with a competitive advantage.

Patents

Our patented inventions along with our strategy to enhance these inventions are at the heart of the Company’s strategy for growth and development.

| 13 |

Our patent portfolio consists of the following:

| Patent Number | Description | |

| US Patent No. 6,438,071 | Concerns the “Method for Producing a 3-D Image” and is also recorded in the European Patents Register #EP 1097393 B1; Australia #55375/99 and Norway #307014. This patent relates to the method for producing a 3D image of a submerged object, e.g. a shipwreck or the sea bottom. | |

| US Patent No. 6,532,192 | Concerns “Subsea Positioning System and Apparatus” | |

| US Patent No. 7,466,628 | Concerns a “Method of constructing mathematical representations of objects from reflected sonar signals.” | |

| US Patent No. 7,489, 592 | Concerns a “Method of automatically performing a patch test for a sonar system, where data from a plurality of overlapping 3D sonar scans of a surface, as the platform is moved, are used to compensate for biases in mounting the sonar system on the platform”. | |

| US Patent No. 7,898,902 | Concerns a “method of representation of sonar images” allowing sonar three dimensional data to be represented by a two dimensional image. | |

| US Patent No. 8,059,486 | Concerns a method of rendering volume representation of sonar images. | |

| US Patent No. 8,854,920 | Concerns a method of volumetric rendering of three dimensional sonar data sets | |

| US Patent No. 9,019,795 | Method of object tracking using sonar imaging |

Trademarks

We own the following registered trademarks: Coda®, Octopus®, CodaOctopus®, Octopus & Design®, F180®, Echoscope®, Survey Engine®, Dimension®, DAseries®, Sentiris® and Thermite®; CodaOctopus®Vantage; CodaOctopus® UIS; and CodaOctopus® USE.

We also use the following trademarks: F170™, F175™, F190™, UIS™ TEAM™ and TEAM+™. In addition, we have registered a number of internet domain names.

Government Regulation

Because of the nature of some of our products, they may be subject to United States and other jurisdictions’ export control regimes and may be exported outside these jurisdictions only with the required level of export license or through an export license exception or general export authorization / license.

In addition, as a provider for the US Government, we may be subject to numerous laws and regulations relating to the award, administration and performance of US Government contracts, including the False Claims Act. Non-compliance found by any one agency could result in fines, penalties, debarment, or suspension from receiving additional contracts with all US Government agencies. Given our dependence on US Government business, suspension or debarment could have a material adverse effect on our business and results of operations.

Employees

As of the date hereof, we employ worldwide 87 people, of which 11 hold management positions. A large majority of our employees have a background in science, technology and engineering, with a substantial part being educated to degree and PhD level. None of our employees are members of any union, and we have not experienced organized labor difficulties in the past.

Not required for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

Lakeland, Florida

Our corporate offices, which co-locate with our wholly owned subsidiary, Coda Octopus Products, Inc., are located in Lakeland Florida. In 2012, the Company acquired this property consisting of 3 unified condominium units with office space and warehouse/storage and testing facilities totaling 4,154 square feet.

Orlando, Florida

Our US subsidiary Coda Octopus Products, Inc., purchased a property in Florida on or around February 2016 for around $730,000. This property will be used by staff who are assigned or seconded from other parts of our Organization to our Florida Office to assist with R&D projects and/or who attend offices in Lakeland from time to time to provide training or demonstration of our products.

| 14 |

Salt Lake City, Utah

On March 21, 2015 Coda Octopus Colmek completed the purchase of new office, production and R&D Facilities comprising 16,000 square feet in Salt Lake City, Utah for $1,200,000 in cash. These premises were further customized for Colmek’s use at a cost of approximately $300,000.

Edinburgh, Scotland

Offices

Our wholly owned United Kingdom subsidiary, Coda Octopus Products Ltd, leases office space comprising 4,099 square feet in Edinburgh, United Kingdom. These premises are used as offices. The building is located close to the Port of Leith and the Firth of Forth, which is convenient for conducting trials and demonstrations of our products. The lease for these premises expires February 28, 2019. The annual rent is fixed for the duration of the lease at the British Pounds equivalent of $54,130 (the rent is stated in British Pounds and is therefore subject to exchange rate fluctuations).

R & D Test Facilities

The Company owns a R&D test facility in Edinburgh, Scotland. These premises comprise 917 square feet and are located immediately adjacent to this business’ principal place of business. The premises were acquired on February 6, 2015 for a purchase price of £130,000 (equivalent to $199,318) and have been equipped with an acoustic test tank for the development and testing of our products and are also utilized for our training activities.

Production and Repair Services Facilities

In keeping with its strategy to develop its own core patented flagship technology (its Real Time 3D Sonar Technology), Coda Octopus Products Ltd is leasing manufacturing and service facilities in Edinburgh comprising 2,450 square feet and located a few hundred yards from the Company’s corporate offices at Anderson House. These new facilities have been equipped with a test tank and will be used to manufacture and service our Echoscope® products. Our flagship product is produced at this newly leased facility. The lease expires September 1, 2018. The annual rent is the British Pounds equivalent of $26,950 (the rent is stated in British Pounds and is therefore subject to exchange rate fluctuations). The rent is fixed for the duration of the lease.

Portland, Dorset, England

Martech leases premises owned by Coda Octopus Products Limited. These premises are located in the Marine Center in Portland, Dorset, United Kingdom, and comprise 9,890 square feet that were acquired by Coda Octopus Products Limited in September 2013. The building comprises both office space and manufacturing and testing facilities. The lease, which is for a period of 5 years, provides for an annual rent of the equivalent of $51,000 (the rent is stated in British Pounds and is therefore subject to exchange rate fluctuations). These premises give easy access to marine facilities such as testing vessels etc.

Bergen, Norway

Our wholly owned Norwegian subsidiary, Coda Octopus R&D AS, leases 2,370 square feet of office space in a refurbished maritime business center directly on the waterway connected to Bergen harbor. After the move of the production and servicing of the Echoscope® to Edinburgh, UK, the facility now serves as a research and development center for hardware development of our flagship product utilizing our purpose-built laboratories. We have served notice to surrender the lease for this facility, effective November 2016.

The lease provides for a rental of the equivalent of $33,959 (the rent is stated in Norwegian Kroners and is therefore subject to exchange rate fluctuations) per annum and expires on May 31, 2018. The lease has been terminated in accordance with its terms with effect from December 1, 2016 and we are seeking to find more appropriately sized facilities in Bergen, Norway, where we still carry on part of our Research and Development works for our core technology.

All non-US Dollar denominated rents are stated according to prevailing exchange rates as of the date of each respective lease agreement.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings that we believe will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

| 15 |

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the OTCQB under the symbol “CDOC”. The following table sets forth the range of high and low bid prices of our common stock as reported and summarized on the OTCQB or OTCQX, as applicable, for the periods indicated. These prices are based on inter-dealer bid and asked prices, without markup, markdown, commissions, or adjustments and may not represent actual transactions.

| Year Ended October 31, 2016 | HIGH | LOW | ||||||

| First Quarter | $ | 0.11 | $ | 0.09 | ||||

| Second Quarter | $ | 0.11 | $ | 0.08 | ||||

| Third Quarter | $ | 0.20 | $ | 0.084 | ||||

| Year Ended October 31, 2015 | HIGH | LOW | ||||||

| First Quarter | $ | 0.08 | $ | 0.05 | ||||

| Second Quarter | $ | 0.07 | $ | 0.06 | ||||

| Third Quarter | $ | 0.12 | $ | 0.06 | ||||

| Fourth Quarter | $ | 0.10 | $ | 0.07 | ||||

| Year Ending October 31, 2014 | HIGH | LOW | ||||||

| First Quarter | $ | 0.07 | $ | 0.09 | ||||

| Second Quarter | $ | 0.07 | $ | 0.06 | ||||

| Third Quarter | $ | 0.12 | $ | 0.06 | ||||

| Fourth Quarter | $ | 0.10 | $ | 0.07 | ||||

We have not declared or paid any cash dividends on our common stock, and we currently intend to retain future earnings, if any, to finance the expansion of our business, and we do not expect to pay any cash dividends in the foreseeable future. The decision whether to pay cash dividends on our common stock will be made by our board of directors, in their discretion, and will depend on our financial condition, operating results, capital requirements and other factors that the board of directors considers significant. As of August 12, 2016, we had 292 stockholders of record and there were 127,078,395 shares of common stock outstanding.

Recent Sales of Unregistered Securities

On March 5, 2013, the Company issued 4,021,280 shares to CCM LLC in full and final satisfaction of an amount of $571,036 (which formed part of a series of small loans which CCM had made available as working capital to the business in March 2011) and in consideration for postponing a portion of the interest payments due.

On July 24, 2014 the Company issued 142,857 shares of common stock to Core Fund LLP in return for the surrender of warrants to purchase shares of common stock of the Company. These warrants were issued to Core Fund in a financing transaction completed in May 2007. The warrants should have been exchanged for shares in October 2010 as part of the Company’s restructuring efforts. As a result of administrative oversight, these shares were not issued until July 2014.

On June 30, 2015 the Company and the Holder of 6,087 shares of Series A Preferred Stock entered into an Exchange Agreement. Under the terms of the Exchange Agreement it was agreed to exchange 6,087 units of Series A Preferred Stock issued and outstanding (and which under the Certificate of Designation provided for dividends and voting rights) for 1,100 units of Series C Preferred Stock. These shares of Series C Preferred Stock each have a nominal value of $0.001 and a stated value of $1,000. The Certificate of Designation for the Series C Preferred Stock does not provide for dividends or voting rights. The 6,087 units of Series A Preferred Stock were surrendered and cancelled by the Company.

On October 26, 2015 the Company issued 100,000 shares of common stock to one of its directors, Robert Ethrington, in accordance with the terms of his election which provided for these shares of common stock to be issued subject to serving at least one year on the Company’s board.

| 16 |

On December 15, 2015 the Company purchased the remaining issued and outstanding 200 shares of Series A Preferred Stock and these have been surrendered and retired. The Series A Preferred Stock was subsequently eliminated and Series B Preferred Stock as a class was also eliminated.

On March 1, 2016 the Company issued 32,346,682 shares of common stock to the Senior Convertible Debenture Holder, CCM LLC, in payment of $3,558,136 which represented the terminal conversion premium outstanding on the said Senior Convertible Debentures.

During May, June and August 2016, the Company issued 100,000 to each of five members of the Board of Directors for their services performed as directors.

In June 2016, the Company issued an aggregate of 112,500 shares valued at $0.093 per share to two individuals for services rendered.

All securities were issued pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended, under Section 4(2) thereunder as they were issued in reliance on the recipients’ representation that they were accredited (as such term is defined in Regulation D), without general solicitation and represented by certificates that were imprinted with a restrictive legend. In addition, all recipients were provided with sufficient access to Company information. Similar restrictions and conditions also apply to the non-freely transferable shares that were issued prior to the last two financial years.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

| 17 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OPERATIONS

Forward-Looking Statements

The information herein contains forward-looking statements. All statements other than statements of historical fact made herein are forward looking. In particular, the statements herein regarding industry prospects and future results of operations or financial position are forward-looking statements. These forward-looking statements can be identified by the use of words such as “believes,” “estimates,” “could,” “possibly,” “probably,” anticipates,” “projects,” “expects,” “may,” “will,” or “should” or other variations or similar words. No assurances can be given that the future results anticipated by the forward-looking statements will be achieved. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Our actual results may differ significantly from management’s expectations.

The following discussion and analysis should be read in conjunction with our financial statements, included herewith. This discussion should not be construed to imply that the results discussed herein will necessarily continue into the future, or that any conclusion reached herein will necessarily be indicative of actual operating results in the future. Such discussion represents only the best present assessment of our management.

General Overview

Preliminary Note

This annual report relates to the fiscal year ended October 31, 2010. Nevertheless, information included in this General Overview is current as of the date of filing of this annual report.

Coda Octopus Group, Inc. (“Coda,” “the Company,” or “we”) designs and manufactures patented real time 3D sonar solutions and other leading products for sale to the subsea, defense, mining and marine sciences markets, among others. In addition, we supply marine engineering business services to prime defense contractors.

We operate through two operating business segments: Marine Technology Business (“Products” segment) and Marine Engineering Business (“Services” segment). Our products are used primarily in the underwater construction market, offshore oil and gas and wind energy industry, and in the complex dredging, port security, mining and marine sciences sectors. Our customers include service providers to major oil and gas companies, law enforcement agencies, ports, mining companies, defense companies and universities.

We supply our marine engineering business services mainly to prime defense contractors. We have been supporting some significant defense programs for over 20 years, including the CIWS (Close In Weapon Support) program that enables us to supply and maintain proprietary parts through obsolescence management programs.

Historically, the Marine Technology Business generated approximately 70% of our revenues. In the last two fiscal years the Marine Technology Business has generated closer to 50% of our overall revenues, with the Marine Engineering Business growing at a faster pace. The slower growth of revenues generated by our Products Segment is largely due to the contraction in the oil and gas (O&G) industry. Due to the effort by O&G companies to restructure their O&G operations, the climate in which we sell is fiercely competitive. As a result, we often have to offer customers greater discount on our sales. Consequently, gross profit margins for our Products Segment have weakened.

Nevertheless, we continue to believe that our unique and patented real time 3D solutions, which allow users to have real time (instantaneous) 3D images of their underwater environment even where there is low or zero visibility conditions, is a significant advancement on the current technology available in the subsea sonar market. Because of its real time capability providing volumetric data of underwater target (including the seabed), this technology reduces the operational costs to users as it does not rely on processing of the underwater data after collection as this is provided in real time, similar to a camera. Many of our customers are reporting significant efficiency gains and therefore cost savings. Furthermore, because the technology provides real time image of the underwater environment of the user, it enhances safety significantly. Many subsea tasks currently performed have limitations due to physical constraints and safety reasons. The technology is therefore used for many tasks that traditionally would be performed by divers and, in some instances, the technology is used as an aid to the diver. This results in significant costs reduction for our customers. In addition, our real time 3D solution is one of two preferred solutions for subsea asset placements (such as Accropodes™, mattress placements, block placements and the like). Due to the decline in the price of oil, many O&G companies are seeking cost effective solutions for their operations. We believe that our real time 3D solution has the potential to revolutionize the technology used in underwater operations particularly where real time visualization is required or zero or low visibility conditions prevail.

| 18 |

In recent years we have made good progress in getting our core real time 3D technology, the Echoscope®, adopted by a significant number of ports in the USA (the CodaOctopus Underwater Inspection System – which integrates our Echoscope, motion sensing product and hydrographic pole) where it is used for port and harbor security. However, until recently we had not managed to replicate this success with foreign ports. In 2015 we secured the first sale of our Underwater Inspection System to a foreign port in Asia and we expect to sell a number of systems to this port for the next three years.

We have also made progress in expanding the markets (and applications) into which we sell our real time 3D Sonars. Recently, we have sold a number of systems to mining companies. Increasingly, our customers involved in energy and renewables are adopting the technology as the primary tool for scour management, subsea cable installation and associated cable protection tasks.

In addition, in recent years we have started to rent our real time 3D solutions with engineering services. Given the contraction in the O&G market, rental is increasingly becoming an important part of the composition of the Company’s revenues.

The following brief overview highlights some of the major issues that currently impact the Company’s business.

The Group’s business is subject to influence from a number of factors including:

| a. | the price of commodities, in particular O&G. The decline in the O&G price has resulted in large scale reduction in capital and operational expenditures budgets, which directly impact on the sales of our products into these and related markets; | |

| b. | the allocation of funds to defense procurement by governments in the USA and UK; | |

| c. | volatility of the markets including the currency market; | |

| d. | uncertainty on the impact of the United Kingdom decision to terminate its current membership of the European Union; | |

| e. | A significant percentage of the Company revenues are generated by the Company’s subsidiaries in the United Kingdom. The decline of the value of sterling is likely to impact our overall revenues which are reported in USD. | |

| f. | In the event that the United Kingdom does not secure access to the European Union Single Market, this is likely to directly impact our cost basis as currently we do not pay export duty on products that we sell to customers in the Single Market; | |

| g. | Global-political uncertainties affecting the markets into which we sell our goods and services; and | |

| h. | the general global economic environment. |

The Group has very limited external sources of capital available, and as such is reliant upon its ability to sell its products and services to provide sufficient working capital for its operations and obligations.

The Company’s operations are split between the United States, United Kingdom, Australia and Norway. A large proportion of our revenues and costs are incurred outside of the USA with a significant part of that in the United Kingdom (“UK”).

On June 23, 2016, the United Kingdom voted to exit the European Union. This resulted in significant currency exchange rate fluctuations and volatility in global stock markets. The British government is expected to commence negotiations to determine the terms of Brexit. The United Kingdom’s separation could, among other things, disrupt trade and the free movement of goods, services and people between the United Kingdom and the European Union or other countries as well as create legal and global economic uncertainty. Currencies could remain volatile for the foreseeable future.

We have already suffered adverse currency movements affecting our UK Businesses subsequent to the reporting period as a result of Brexit. Given the lack of comparable precedent, the implications of Brexit or how such implications might affect the Company in the medium to long term are unclear.

Critical Accounting Policies

This discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements that have been prepared under accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with US GAAP requires our management to make estimates and assumptions that affect the reported values of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported levels of revenue and expenses during the reporting period. Actual results could materially differ from those estimates.

Below is a discussion of accounting policies that we consider critical to an understanding of our financial condition and operating results and that may require complex judgment in their application or require estimates about matters which are inherently uncertain. A discussion of our significant accounting policies, including further discussion of the accounting policies described below, can be found in Note 1, “Summary of Significant Accounting Policies” of our Consolidated Financial Statements.

| 19 |

Revenue Recognition

We record revenue in accordance FASB ASC Topic 605 - Revenue Recognition.

Revenue is derived from our products sold by our subsidiaries, Coda Octopus Products Inc. and Coda Octopus Products Ltd., from sales of underwater technologies and equipment for imaging, mapping, defense and survey applications. Revenue is also derived through service contracts gained by our Martech and Colmek businesses. In 2014 we opened a sales office in Australia, under the name Coda Octopus Products Pty Limited.

Revenue is recognized when conclusive evidence of firm arrangement exists, delivery has occurred or services have been rendered, the contract price is fixed or determinable, and collectability is reasonably assured. No right of return privileges are granted to customers after shipment.

For arrangements with multiple deliverables, we recognize product revenue by allocating the revenue to each deliverable based on the fair value of each deliverable in accordance with ASC 605, and recognize revenue for equipment upon delivery and for installation and other services as performed. ASC 605 was effective for revenue arrangements entered into in fiscal periods beginning after June 15, 2003.

Our contracts typically require customer payments in advance of revenue recognition. These deposit amounts are reflected as liabilities and recognized as revenue when the Company has fulfilled its obligations under the respective contracts.

Revenues derived from our software license sales are recognized in accordance with FASB ASC Topic 985 - Software. For software license sales for which any services rendered are not considered essential to the functionality of the software, we recognize revenue upon delivery of the software, provided (1) there is evidence of an arrangement, (2) collection of our fee is considered probable and (3) the fee is fixed and determinable.

Recoverability of Deferred Costs

We defer costs on projects for service revenue. Deferred costs consist primarily of direct and incremental costs to customize and install systems, as defined in individual customer contracts, including costs to acquire hardware and software from third parties and payroll costs for our employees and other third parties.

We recognize such costs in accordance with our revenue recognition policy by contract. For revenue recognized under the completed contract method, costs are deferred until the products are delivered, or upon completion of services or, where applicable, customer acceptance. For revenue recognized under the percentage of completion method, costs are recognized as products are delivered or services are provided in accordance with the percentage of completion calculation. For revenue recognized ratably over the term of the contract, costs are recognized ratably over the term of the contract, commencing on the date of revenue recognition. At each balance sheet date, we review deferred costs, to ensure they are ultimately recoverable. Any anticipated losses on uncompleted contracts are recognized when evidence indicates the estimated total cost of a contract exceeds its estimated total revenue.

Stock Based Compensation

The Company accounts for stock-based compensation in accordance with FASB ASC Topic 718 “Compensation - Stock Compensation” (“ASC 718”). Under the fair value recognition provisions of this statement, share-based compensation cost is measured at the grant date based on the value of the award. This value is expensed ratably over the vesting period for time-based awards and when the achievement of performance goals is probable in our opinion for performance-based awards. Determining the fair value of share-based awards at the grant date requires judgment; including volatility, terms, and estimating the amount of share-based awards that are expected to be forfeited. If actual results differ significantly from these estimates, stock based compensation expense and the Company’s results of operations could be materially impacted.

Income Taxes

Deferred income taxes are provided using the asset and liability method for financial reporting purposes in accordance with the provisions of FASB ASC 740 - Income Taxes. Under this method, deferred tax assets and liabilities are recognized for temporary differences between the tax bases of assets and liabilities and their carrying values for financial reporting purposes and for operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be removed or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the consolidated statements of operations in the period that includes the enactment date.

| 20 |

Purchase price allocation and impairment of intangible and long-lived assets

Intangible and long-lived assets to be held and used are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amounts of such assets may not be recoverable. Determination of recoverability is based on an estimate of undiscounted future cash flows resulting from the use of the asset, and its eventual disposition. Measurement of an impairment loss for intangible and long-lived assets that management expects to hold and use is based on the fair value of the asset as estimated using a discounted cash flow model.

We measure the carrying value of goodwill recorded in connection with the acquisitions for potential impairment in accordance with ASC 350 - Intangibles - Goodwill and Other. To apply ASC 350, a company is divided into separate “reporting units”, each representing groups of products that are separately managed. For this purpose, we have one reporting unit. To determine whether or not goodwill may be impaired, a test is required at least annually, and more often when there is a change in circumstances that could result in an impairment of goodwill. If the market capitalization of our common stock is below book carrying value for a sustained period, or if other negative trends occur in our results of operations, a goodwill impairment test will be performed by comparing book value to estimated market value. To the extent goodwill is determined to be impaired an impairment charge is recorded in accordance with ASC 350.

Results of Operations

General

Cash Framework Agreement

On March 16, 2009 the Company entered a “Cash Control Framework Agreement” with the holder of the Company’s Senior Secured Debentures, under which the Company obtained working capital secured by invoices. This facility provided a debtor book financing package to allow the Company to obtain up to $2.15 in working capital against the security in and/or over the receivables. The Parties agreed to terminate this agreement in March 2011.

Reorganization

As part of the Company’s cost cutting and reorganization efforts, during fiscal 2009, the Company’s replaced its management, including the President and CEO, the SVPs, and the Board of Directors.

On or around October 18, 2010 our subsidiary, Coda Octopus Martech, entered into an arrangement (Company Voluntary Arrangement or CVA) under which it was agreed to re-schedule £503,335 (an equivalent of $807,000 using an exchange rate of 1.6035) amounts to trade creditors. Under the CVA this amount was scheduled to be repaid over 4 years.