UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No.)

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

CODA OCTOPUS GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials: | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

CODA OCTOPUS GROUP, INC.

3300 S Hiawassee Rd., Suite 104-105

Orlando, Florida 32835

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

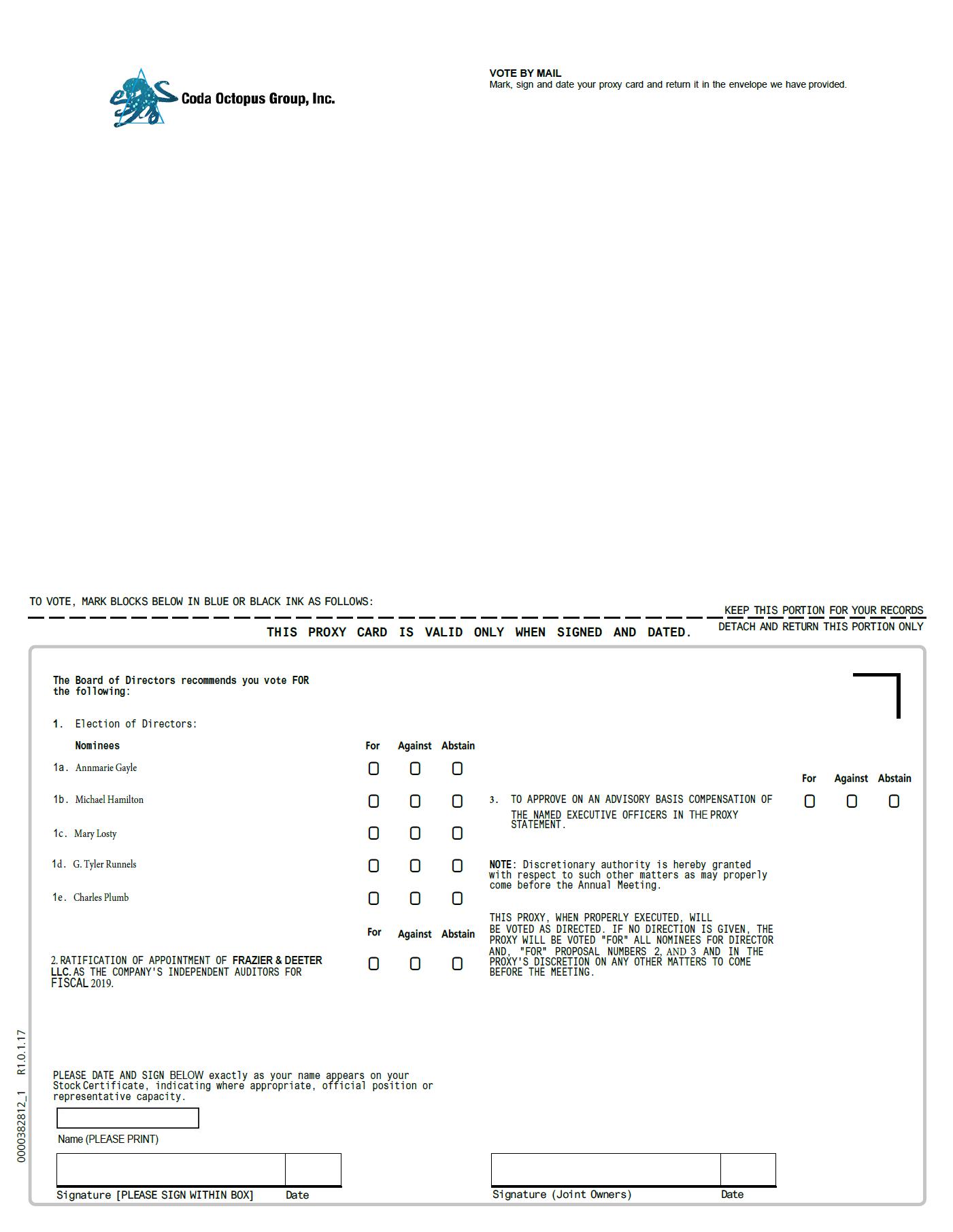

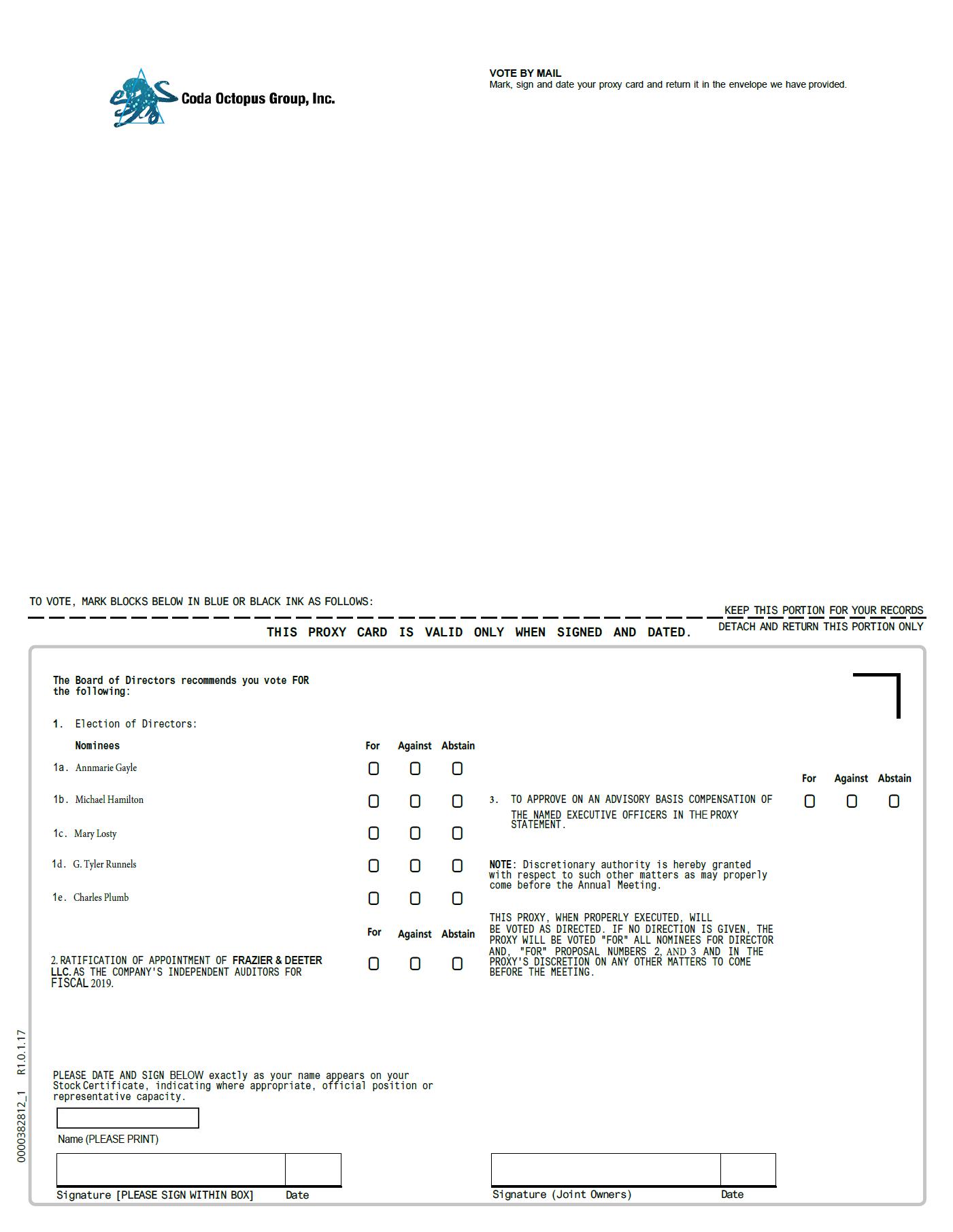

The Annual Meeting of Stockholders of Coda Octopus Group, Inc. will be held on September 10, 2019, at 10:00 a.m., Pacific Daylight Time, at the offices of T.R. Winston located at 2049 Century Park East, Suite 320, Los Angeles, California 90067 for the following purposes:

| 1. | To elect five directors to serve until the annual meeting of stockholders in 2020 or until their respective successors have been duly elected and qualified; |

| 2. | To vote on a proposal to ratify the appointment of Frazier & Deeter, LLC as the Company’s independent registered public accounting firm for 2019; |

| 3. | To vote, on an advisory basis, on a proposal to approve the compensation of our named executive officers; and |

| 4. | To transact such other business as may properly come before the meeting. |

Only stockholders of record at the close of business on July 22, 2019 are entitled to notice of and to vote at the Annual Meeting or any postponements or adjournments thereof.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting in person, we encourage you to complete and return your proxy card or voting instruction form at your earliest convenience.

| By Order of the Board of Directors | |

| Annmarie Gayle | |

| Chairman and Chief Executive Officer |

Orlando, Florida

July ____, 2019

CODA OCTOPUS GROUP, INC.

3300 S Hiawassee Rd., Suite 104-105

Orlando, Florida 32835

PROXY STATEMENT

General

We are providing this proxy statement in connection with the solicitation by the Board of Directors of Coda Octopus Group, Inc. of proxies to be voted at our Annual Meeting of Stockholders and at any postponement or adjournment of the meeting. Our Annual Meeting will be held on September 10, 2019, at 10:00 a.m., Pacific Daylight Time, at the offices of T.R Winston located at 2049 Century Park East, Los Angeles, California 90067.

Our proxy materials are being made available to our stockholders beginning on or about August 3, 2019.

Solicitation of proxies on behalf of the Board of Directors may be made by our employees through the mail or in person. We will pay all costs of the solicitation. We also will reimburse brokerage houses and other nominees for their reasonable expenses in forwarding proxy materials to beneficial owners

Outstanding Securities and Voting Rights

Only holders of record of our common stock at the close of business on July 22, 2019, the record date, will be entitled to notice of, and to vote at, the Annual Meeting. On the record date, 10,671,524 shares of our common stock were issued and outstanding.

Each holder of record of our common stock as of the record date is entitled to cast one vote per share. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Directors are elected by a plurality of the votes cast. Abstentions, although counted for purposes of determining whether there is a quorum, will have no effect on the vote. In addition, where brokers are prohibited from exercising discretionary authority in voting on a matter because beneficial owners have not provided voting instructions (commonly referred to as “broker non-votes”), the broker-non-votes will have no effect on the vote. However, if shares are deemed represented for any purpose at the meeting (for example, with respect to a matter for which a broker is permitted to exercise discretionary voting authority), the shares will be counted for purposes of determining whether there is a quorum at the meeting.

Under Delaware law, none of our stockholders are entitled to rights of appraisal on any proposal referred to herein.

How to Vote

The process for voting your shares depends on how your shares are held. Generally, you may hold shares as a record holder or through a broker, bank or other nominee. If your shares are registered directly in your name with our transfer agent, Olde Monmouth Stock Transfer Co., Inc., you are considered a record holder with respect to such shares. If your shares are held through a bank, broker, or other nominee (such shares are often referred to as being held in “street name”), you are considered a beneficial owner of the shares held in street name.

Voting by Stockholders of Record

If you are a record holder, you may vote through one of the following methods:

| ● | attend the Annual Meeting and submit a ballot; or | |

| ● | sign and date each proxy card you receive and return it in the prepaid envelope included in your proxy materials; |

Shares for which voting instructions are provided by properly executed and returned proxy cards will be voted at the Annual Meeting in accordance with the instructions provided. If a proxy is provided without voting instructions, the shares represented by the proxy will be voted FOR the election of each of the five nominees for election as director named in this proxy statement, FOR ratification of the appointment of Frazier & Deeter LLC as our independent registered public accounting firm for 2019 and FOR a proposal to approve the compensation of our named executive officers. You may revoke your proxy at any time prior to its use by delivering or mailing to our Corporate Secretary at the address listed above a signed notice of revocation or a later-dated signed proxy, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in itself constitute the revocation of a proxy.

Voting by Beneficial Owners of Shares Held in Street Name

If your shares are held in the name of a broker, bank or other nominee (in other words, your shares are held in street name), please refer to the instructions provided by that firm for voting your shares, including information as to whether the firm offers internet or telephone voting. If you want to vote those shares in person at the Annual Meeting, you must bring a signed proxy from the broker, bank or other nominee, indicating that you were a beneficial owner of shares as of the close of business on July 22, 2019, as well as the number of shares of which you were the beneficial owner on the record date, and appointing you as the record holder’s proxy to vote the shares covered by that proxy at the Annual Meeting.

Under New York Stock Exchange rules for member organizations, a broker holding shares for the account of a beneficial owner is not permitted to vote the shares on the election of directors or on the advisory vote on executive compensation unless it receives voting instructions from the beneficial owner. Although Coda Octopus Group, Inc. is listed on the Nasdaq Capital Market, the NYSE rules affect us because a portion of the common stock held in street name is held by NYSE member brokers. Therefore, if your shares are held by a broker, it is important that you provide voting instructions to your broker so that your vote with respect to these matters is counted.

If you wish to revoke your voting instructions, you should contact the broker, bank or other nominees that holds your shares in street name for information on how to revoke your voting instructions.

| 2 |

PROPOSAL 1. ELECTION OF DIRECTORS

Nominees for Election and Executive Officers

At the annual meeting, five directors are to be elected for a term expiring at our 2020 annual meeting or until their successors have been duly elected and qualified.

The Board of Directors believes that its nominees described below will be able to serve as directors, if elected. If any nominee is unable to serve, proxies will be voted for the election of such other person as the Board of Directors may recommend.

Set forth below is certain information concerning the nominees for election as directors:

| Name | Age | Position | ||

| Annmarie Gayle | 52 | Chairman and Chief Executive Officer | ||

| Michael Hamilton | 72 | Director | ||

| Mary Losty | 59 | Director | ||

| G. Tyler Runnels | 62 | Director | ||

| Joseph Charles Plumb | 76 | Director Nominee |

Annmarie Gayle has been our Chief Executive Officer and a member of the Board of Directors since 2011 and our Chairman since March 2017. She is also our Chief Executive Officer for our flagship products business, Coda Octopus Products, Limited (UK) since 2013. Prior thereto, she spent two years assisting with the restructuring of our Company. She previously served with the Company as Senior Vice President of Legal Affairs between 2006 and 2007. Earlier in her career she worked for a major London law practice, the United Nations and the European Union. Ms. Gayle has a strong background in restructuring and has spent more than 12 years in a number of countries where she has been the lead adviser to a number of transitional administrations on privatizing banks and reforming state-owned assets in the Central Eastern European countries including banking, infrastructure, mining and telecommunications assets. Ms. Gayle has also managed a number of large European Union funded projects. Ms. Gayle holds a Law degree gained at the University of London and a Masters of Law degree in International Commercial Law from Cambridge University. She is qualified to practice as a solicitor in England & Wales. Because of her wealth of experience in corporate governance, large scale project management, restructuring, strategy, structuring and managing corporate transactions, we believe that she is highly qualified to act as our Chairman and Chief Executive Officer.

Michael Hamilton was our Chairman of the Board between June 2010 and March 2017. He is currently serving as an independent director of our Board. Since 2014, Mr. Hamilton has provided accounting and valuation services for a varied list of clients. He was Senior Vice President of Powerlink Transmission Company from 2011 through 2014. From 1988 to 2003, he was an audit partner at PriceWaterhouseCoopers. He holds a Bachelor of Science in Accounting from St. Frances College and is a certified public accountant and is accredited in business valuation. Because of Mr. Hamilton’s background in auditing, strategic corporate finance solutions, financial management and financial reporting, we believe that he is highly qualified to be a member of our Board of Directors.

Mary Losty has been a director since July 2017. She is a private investor in both US equities and real estate. She currently serves as Commissioner on both Dorchester County and the City of Cambridge, Maryland’s Planning and Zoning Commissions. She also serves as a Committeeman for the Eastern Shore Land Conservancy as well as the Pine Street Committee of Cambridge, MD. She served as a member of the Board of Procera Networks, Inc. from March 2007 until that company was successfully sold in June 2015 to a private equity firm. She was a member of that company’s Audit Committee and the former Chairman of the Nominating and Governance Committee. Ms. Losty was a director of Blue Earth, Inc. (formerly Genesis Fluid Solutions Holdings, Inc.) from 2009 to 2011. Ms. Losty retired in 2010 as the General Partner at Cornwall Asset Management, LLC, a portfolio management firm located in Baltimore, Maryland, where she was responsible for the firm’s investment in numerous companies since 1998. Ms. Losty’s prior experience includes working as a portfolio manager at Duggan & Associates from 1992 to 1998 and as an equity research analyst at M. Kimelman & Company from 1990 to 1992. Prior to that, she worked as an investment banker at Morgan Stanley and Co., and for several years prior to that she was the top aide to James R. Schlesinger, a five-time U.S. cabinet secretary. Ms. Losty received both her BS and JD from Georgetown University, the latter with magna cum laude distinction. We believe that Ms. Losty’s extensive dealings with the investment community makes her highly qualified to be a member of our Board of Directors.

| 3 |

G. Tyler Runnels has been a director since July 2018. Mr. Runnels has nearly 30 years of investment banking experience including debt and equity financings, private placements, mergers and acquisitions, initial public offerings, bridge financings, and financial restructurings. Since 2003 Mr. Runnels has been the Chairman and Chief Executive Officer of T.R. Winston & Company, LLC, an investment bank and member of FINRA, where he began working in 1990. Mr. Runnels was an early stage investor in our company and T.R. Winston & Company, LLC has served as our exclusive placement agent in one of our private placements raising early rounds of capital for our company. Mr. Runnels has successfully completed and advised on numerous transactions for clients in a variety of industries, including healthcare, oil and gas, business services, manufacturing, and technology. Mr. Runnels is also responsible for working with high net worth clients seeking to diversify their portfolios to include real estate products through established relationships with real estate brokers, accountants, attorneys, qualified intermediaries and financial advisors. Prior to joining T.R. Winston & Co., LLC, Mr. Runnels held the position of Senior Vice President of Corporate Finance for H.J. Meyers & Company, a regional investment bank. Mr. Runnels serves on the Pepperdine University President’s Campaign Cabinet. Mr. Runnels received a B.S. and MBA from Pepperdine University. Mr. Runnels holds FINRA Series 7, 24, 55, 63 and 79 licenses. We selected Mr. Runnels to serve on our board of directors based upon his significant experience both as an investor and advisor, as well as his experience as a board member of a number of listed companies.

Joseph Charlie Plumb is a retired U.S. Navy fighter pilot. On his 75th combat mission, just five days before the end of his tour in Vietnam, he was shot down over Hanoi, taken prisoner and tortured. During his nearly six years as a prisoner of war, he distinguished himself as a pro in underground communications. He was a great inspiration to all the other POWs and served as chaplain for two years. Following his repatriation, Plumb continued his Navy flying career in Reserve Squadrons where he flew A-4 Sky Hawks, A-7 Corsairs and FA-18 Hornets. His last two commands as a Naval Reservist were on the Aircraft Carrier Corral Sea and at a Fighter Air Wing in California. He retired from the United States Navy after 28 years of service. His military honors include two Purple Hearts, the Legion of Merit, the Silver Star, the Bronze Star and the P.O.W. Medal. He has been a motivational speaker, consultant and executive coach since 1973. His clients include General Motors, Fedex, Hilton, Aflac, the U.S. Navy, BMW and NASA. Since 2010, he has been member of the Board of Directors of the Lightspeed Aviation Foundation. Mr. Plumb earned a B.S. in electrical engineering from the U.S. Naval Academy at Annapolis. We selected Mr. Plumb because of his close ties to the U.S. Defense establishment.

Family Relationships

Other than G. Tyler Runnels and Charlie Plumb, who are brothers in law, none of our Directors or Director nominees are related by blood, marriage, or adoption to any other Director, executive officer, or other key employees.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF ITS NOMINEES FOR ELECTION AS A DIRECTOR.

CORPORATE GOVERNANCE

Board Leadership Structure

The Board of Directors is currently chaired by the Chief Executive Officer of the Company, Annmarie Gayle. The Company believes that combining the positions of Chief Executive Officer and Chairman of the Board of Directors helps to ensure that the Board of Directors and management act with a common purpose. Integrating the positions of Chief Executive Officer and Chairman can provide a clear chain of command to execute the Company’s strategic initiatives. The Company also believes that it is advantageous to have a Chairman with an extensive history with and knowledge of the Company. Notwithstanding the combined role of Chief Executive Officer and Chairman, key strategic initiatives and decisions involving the Company are discussed and approved by the entire Board of Directors. The Company believes that the current leadership structure and processes maintain an effective oversight of management and independence of the Board of Directors as a whole without separate designation of a lead independent director. However, the Board of Directors will continue to monitor its functioning and will consider appropriate changes to ensure the effective independent function of the Board of Directors in its oversight responsibilities.

| 4 |

Independence of the Board of Directors and its Committees

After review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its Independent Registered Public Accounting Firm, the Board of Directors has determined that all of the Company’s directors are independent within the meaning of the applicable NASDAQ listing standards, except Ms. Gayle, the Company’s Chairman and Chief Executive Officer. The Board of Directors met six times and acted by unanimous written consent once during the fiscal year ended October 31, 2018. Each member of the Board of Directors attended all meetings of the Board of Directors held in the last fiscal year during the period for which he or she was a director and of the meetings of the committees on which he or she served held in the last fiscal year during the period for which he or she was a committee member.

The Board of Directors has three committees: the Audit Committee, the Compensation Committee and the Nominating Committee. Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors oversees the Company’s corporate accounting and financial reporting process. For this purpose, the Audit Committee performs several functions. The Audit Committee, among other things: evaluates the performance, and assesses the qualifications, of the Independent Registered Public Accounting Firm; determines and pre-approves the engagement of the Independent Registered Public Accounting Firm to perform all proposed audit, review and attest services; reviews and pre-approves the retention of the Independent Registered Public Accounting Firm to perform any proposed, permissible non-audit services; determines whether to retain or terminate the existing Independent Registered Public Accounting Firm or to appoint and engage a new Independent Registered Public Accounting Firm for the ensuing year; confers with management and the Independent Registered Public Accounting Firm regarding the effectiveness of internal controls over financial reporting; establishes procedures as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; reviews the financial statements to be included in the Company’s Annual Report on Form 10-K and recommends whether or not such financial statements should be so included; and discusses with management and the Independent Registered Public Accounting Firm the results of the annual audit and review of the Company’s quarterly financial statements.

The Audit Committee is currently composed of three outside directors: Michael Hamilton (Chairman), Mary Losty and Per Wimmer. The Audit Committee met four times during the fiscal year ended October 31, 2018. Mr.Wimmer is not standing for reelection. The Audit Committee Charter is available on the Company’s website, www.codaoctopusgroup.com.

The Board of Directors periodically reviews the NASDAQ listing standards’ definition of independence for Audit Committee members and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A) of the NASDAQ listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended). The Board of Directors has determined that Michael Hamilton qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board of Directors made a qualitative assessment of Mr. Hamilton’s level of knowledge and experience based on a number of factors, including his formal education and his service in professional capacities having financial oversight responsibilities.

Compensation Committee

The Compensation Committee of the Board of Directors reviews, modifies and approves the overall compensation strategy and policies for the Company. The Compensation Committee, among other things: reviews and approves corporate performance goals and objectives relevant to the compensation of the Company’s officers; determines and approves the compensation and other terms of employment of the Company’s Chief Executive Officer; determines and approves the compensation and other terms of employment of the other officers of the Company; and administers the Company’s stock option and purchase plans, pension and profit sharing plans and other similar programs.

| 5 |

The Compensation Committee is currently composed of three outside directors: Per Wimmer (Chair), Mary Losty and G. Tyler Runnels. Mr. Wimmer is not standing for reelection. All members of the Compensation Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Compensation Committee met once during the fiscal year ended October 31, 2018. The Compensation Committee Charter is available on the Company’s website, www.codaoctopusgroup.com.

Compensation Committee Interlocks and Insider Participation

No member of our compensation committee has at any time been an employee of ours. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Nominating Committee

The Nominating Committee of the Board of Directors is responsible for, among other things: identifying, reviewing and evaluating candidates to serve as directors of the Company; reviewing, evaluating and considering incumbent directors; recommending to the Board of Directors for selection candidates for election to the Board of Directors; making recommendations to the Board of Directors regarding the membership of the committees of the Board of Directors; and assessing the performance of the Board of Directors.

The Nominating and Governance Committee is currently composed of three outside directors: Per Wimmer (Chair), Mary Losty and G. Tyler Runnels. Mr. Wimmer is not standing for reelection. All members of the Nominating Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Nominating Committee did not meet during the fiscal year ended October 31, 2018. The Nominating Committee Charter is available on the Company’s website, www.codaoctopusgroup.com.

The Nominating Committee has not established any specific minimum qualifications that must be met for recommendation for a position on the Board of Directors. Instead, in considering candidates for director the Nominating Committee will generally consider all relevant factors, including among others the candidate’s applicable education, expertise and demonstrated excellence in his or her field, the usefulness of the expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, experience and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board of Directors (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its stockholders.

The Nominating Committee considers each director’s executive experience and his or her familiarity and experience with the various operational, scientific and/or financial aspects of managing companies in our industry.

With respect to diversity, the Nominating Committee seeks a diverse group of individuals who have executive leadership experience and a complementary mix of backgrounds and skills necessary to provide meaningful oversight of the Company’s activities. The Nominating Committee annually reviews the Board’s composition in light of the Company’s changing requirements. The Nominating Committee uses the Board of Director’s network of contacts when compiling a list of potential director candidates and may also engage outside consultants. Pursuant to its charter, the Nominating Committee will consider, but not necessarily recommend to the Board of Directors, potential director candidates recommended by stockholders. All potential director candidates are evaluated based on the factors set forth above, and the Nominating Committee has established no special procedure for the consideration of director candidates recommended by stockholders.

Code of Ethics

We have a Code of Ethics applicable to all of our officers, other employees and directors. The Code of Ethics is available on the Company’s website, www.codaoctopusgroup.com.

| 6 |

Employment Agreements

Annmarie Gayle

Pursuant to the terms of an employment agreement dated March 16, 2017, the Company employs Ms. Gayle as its Chief Executive Officer on a full-time basis and a member of its Board of Directors. The annual salary is $230,000 payable on a monthly basis. Ms. Gayle is also entitled to an annual performance bonus of up to $100,000, upon achieving certain targets that are to be defined on an annual basis. The agreement provides for 30 days of paid holidays in addition to public holidays observed in Scotland.

The agreement has no definitive term and may be terminated only upon twelve months’ prior written notice by Ms. Gayle. In the event that the Company terminates her at any time without cause, she is entitled to a payment equal to her annual salary as well as a separation bonus of $150,000. The Company may terminate the agreement for cause, immediately and without notice. Among others, “for cause” includes gross misconduct, a serious or repeated breach of the agreement and negligence and incompetence as reasonably determined by the Company’s Board. The agreement includes a 12-month non-compete and non-solicitation provision.

In accordance with the terms of her employment agreement, on June 12, 2019, the Compensation Committee resolved to increase Ms. Gayle’s cash compensation to $305,000 per annum, effective July 1, 2019.

Blair Cunningham

Under the terms of an employment contract dated January 1, 2013, our wholly owned subsidiary Coda Octopus Products, Inc. employs Blair Cunningham as its Chief Executive Officer and President of Technology. He is being paid an annual base salary of $175,000 with effect from January 1, 2018, subject to review by the Company’s Chief Executive Officer. Mr. Cunningham is entitled to 25 vacation days in addition to any public holiday.

The agreement may be terminated only upon twelve-month prior written notice without cause. The Company may terminate the agreement for cause, immediately and without notice. Among others, “for cause” includes gross misconduct, a serious or repeated breach of the agreement and negligence and incompetence as reasonably determined by the Company’s Board. The agreement includes a 18-month non-compete and non-solicitation provision.

Michael Midgley

Pursuant to the terms of an employment agreement dated June 1, 2011, Mike Midgley was appointed the Chief Executive Officer of our wholly owned subsidiary Coda Octopus Colmek, Inc. (“Colmek”) and our Chief Financial Officer. He is being paid an annual salary of $200,000 subject to an annual review by Colmek’s Board of Directors and the Company’s Chief Executive Officer. Mr. Midgley is entitled to 20 vacation days in addition to any public holiday.

The agreement may be terminated at any time upon 4 months prior written notice. The Company may terminate the agreement for cause, immediately and without notice. Among others, “for cause” includes gross misconduct, a serious or repeated breach of the agreement and negligence and incompetence as reasonably determined by the Company’s Board. The agreement includes a 12-month non-compete and non-solicitation provision. On December 6, 2017, the Board of Directors of the Company appointed Mr. Midgley to be the Company’s Chief Financial Officer. In connection with this appointment, all rights and obligations under Mr. Midgley’s employment agreement with Colmek were transferred to and have been assumed by the Company.

| 7 |

EXECUTIVE COMPENSATION

Executive Officers

| Name | Age | Position | ||

| Annmarie Gayle | 51 | Chairman and Chief Executive Officer | ||

| Michael Midgley | 67 | Chief Financial Officer, Chief Executive Officer of Coda Octopus Colmek, Inc. | ||

| Blair Cunningham | 48 | President of Technology |

Annmarie Gayle. For information regarding Ms. Gayle, please see Proposal 1 discussed above.

Michael Midgley has been our Chief Financial Officer since December 2017 and our acting Chief Financial Officer since 2013. He has also been Chief Executive Officer of Colmek since 2010, which he joined in 2008. He is a qualified CPA and has had his own practice as well as working for regional accounting firms, specializing in SEC and Tax practice areas. Mr. Midgley attended the University of Utah where he obtained a BA in Accounting. Due to Mr. Midgley’s expertise in financial reporting, we believe that he is highly qualified to serve as the Company’s Chief Financial Officer.

Blair Cunningham has been with the Company since July 2004 and has had a number of roles including President of Technology and CEO of Coda Octopus Products, Inc. (current positions), Chief Technology Officer since 2005 and Technical Manager of Coda Octopus Products Ltd between July 2004 and July 2005. Mr. Cunningham received an HND in Computer Science in 1989 from Moray College of Further Education, Elgin, Scotland. Because of Mr. Cunningham’s expertise in technology, systems software development and project management, the Company believes that he is highly qualified to serve in his current roles.

Summary Compensation Table

The Summary Compensation Table shows certain compensation information for services rendered for the fiscal years ended October 31, 2018 and 2017 by our executive officers. The following information includes the dollar value of base salaries, bonus awards, stock options grants and certain other compensation, if any, whether paid or deferred. In accordance with the Commission’s rules, the table omits columns showing items that are not applicable.

| Name and Principal Position | Year | Salary | * All Other Compensation | Total | ||||||||||||

| ($) | ($) | ($) | ||||||||||||||

| Annmarie Gayle, | 2018 | 230,000 | -0- | 230,000 | ||||||||||||

| Chief Executive Officer | 2017 | 230,000 | -0- | 230,000 | ||||||||||||

| Michael Midgley | 2018 | 200,000 | 11,558 | 211,558 | ||||||||||||

| Chief Financial Officer | 2017 | 200,000 | 13,332 | 213,332 | ||||||||||||

| Blair Cunningham | 2018 | 172,000 | 18,085 | 190,085 | ||||||||||||

| President of Technology | 2017 | 160,000 | 17,393 | 177,393 | ||||||||||||

*The amounts described in the category of “All Other Compensation” comprise Health, Dental, Vision, Short Term Disability, Long Term Disability and Accidental Death and Dismemberment insurance premiums which the Company contributed to the officers’ identified plan.

| 8 |

DIRECTOR COMPENSATION

The following table sets forth the compensation paid to each of our directors (who are not also officers of the Company) for the fiscal year ended October 31, 2018, in connection with their services to the company. In accordance with the Commission’s rules, the table omits columns showing items that are not applicable. Except as set forth in the table, no persons were paid any compensation for director services.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Total ($) | |||||||||

| Michael Hamilton | 26,667 | 26,667 | ||||||||||

| *Francis (Chuck) Rogers | 10,000 | 10,000 | ||||||||||

| Per Wimmer | 10,000 | 10,000 | ||||||||||

| *Nina Hoque | 8,967 | 8,967 | ||||||||||

| Mary Losty | 10,000 | 10,000 | ||||||||||

| G. Tyler Runnels | 2,500 | 2,500 | ||||||||||

*Both have since retired from our Board of Directors

2017 Stock Incentive Plan

On December 6, 2017, the Board of Directors adopted the 2017 Stock Incentive Plan (the “Plan”). The purpose of the Plan is to advance the interests of the Company and its stockholders by enabling the Company and its subsidiaries to attract and retain qualified individuals through opportunities for equity participation in the Company, and to reward those individuals who contribute to the Company’s achievement of its economic objectives. The Plan was adopted subject to stockholders’ approval. The Plan was approved by Stockholders at the Company’s 2018 annual meeting.

The maximum number of shares of Common Stock that will be available for issuance under the Plan will be 913,612. The shares available for issuance under the Plan may, at the election of the Committee, be either treasury shares or shares authorized but unissued, and, if treasury shares are used, all references in the Plan to the issuance of shares will, for corporate law purposes, be deemed to mean the transfer of shares from treasury.

The Plan is administered by the Compensation Committee of the Board of Directors which has the authority to determine all provisions of Incentive Awards as the Committee may deem necessary or desirable and as consistent with the terms of the Plan, including, without limitation, the following: (i) eligible recipients; (ii) the nature and extent of the Incentive Awards to be made to each Participant; (iii) the time or times when Incentive Awards will be granted; (iv) the duration of each Incentive Award; and (v) the restrictions and other conditions to which the payment or vesting of Incentive Awards may be subject.

No awards have been made under the Plan to date.

| 9 |

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of July 22, 2019, regarding the beneficial ownership of our Common Stock, based on information provided by (i) each of our executive officers and directors; (ii) all executive officers and directors as a group; and (iii) each person who is known by us to beneficially own more than 5% of the outstanding shares of our Common Stock. The percentage ownership in this table is based on 10,671,524 shares issued and outstanding as of July 22, 2019.

Unless otherwise indicated, we believe that all persons named in the following table have sole voting and investment power with respect to all shares of Common Stock that they beneficially own.

| Name and Address of Beneficial Owner (1) | Amount and Nature of Beneficial Ownership of Common Stock | Percent of Common Stock | ||||||

| Michael Hamilton | 7,143 | * | ||||||

| Annmarie Gayle (2) | 13,037 | * | ||||||

| Michael Midgley | 7,143 | * | ||||||

| Blair Cunningham | 24,297 | * | ||||||

| Per Wimmer | 7,143 | * | ||||||

| Mary Losty (3) | 82,143 | * | ||||||

| Niels Sondergaard Carit Etlars Vej 17A 8700 Horsens Denmark | 2,317,486 | 21.7 | % | |||||

G. Tyler Runnels (4) 2049 Century Park East, Suite 320 Los Angeles, CA 90067 | 1,290,549 | 12.1 | % | |||||

J. Steven Emerson (5) 1522 Ensley Avenue Los Angeles, CA 90024 | 1,048,935 | 9.8 | % | |||||

Bryan Ezralow (6) 23622 Calabasas Rd. Suite 200 Calabasas, CA 91302 | 1,083,610 | 10.2 | % | |||||

FH Fentener van Vlissingen (7) Albert Hahnplantsoen 23 Amsterdam The Netherlands | 1,023,012 | 9.6 | % | |||||

| All Directors and Executive Officers as a Group (Seven persons): | 1,431,455 | 13.4 | % | |||||

*) Less than 1%.

| 1) | Unless otherwise indicated, the address of all individuals and entities listed is c/o Coda Octopus Group, Inc., 3300 S Hiawassee Rd., Suite 104-105, Orlando, Florida 32835. |

| 2) | Does not include 2,317,486 shares beneficially owned by Ms. Gayle’s domestic partner. Ms. Gayle disclaims any beneficial ownership in those shares. |

| 3) | Of these shares, 75,000 shares have been pledged as collateral security for a loan. |

| 4) | Includes 1,024,195 shares held by the G. Tyler Runnels and Jasmine Niklas Runnels TTEES of The Runnels Family Trust DTD 1-11-2000 of which Mr. Runnels is a trustee; 227,700 shares held by T.R. Winston; 24,368 shares held by TRW Capital Growth Fund, Ltd.; and 14,286 shares held by Pangaea Partners. The Company has been advised that Mr. Runnels has voting and dispositive power with respect to all of these shares. |

| 5) | Includes the following: 138,776 held by J.Steven Emerson IRA R/O II; 187,878 shares held by J Steven Emerson Roth IRA; 49,328 shares held by the Brian Emerson IRA; 300,355 shares held by Emerson Partners; 8,286 shares held by the Alleghany Meadows IRA; and 8,286 shares held by the Jill Meadows IRA. The Company has been advised that Mr. Emerson has voting and dispositive power with respect to all of these shares. |

| 6) | Consists of 912,569 shares held by the Bryan Ezralow 1994 Trust u/t/d 12/22/1994; and 171,041 shares held by EZ MM&B Holdings, LLC. The Company has been advised that Mr. Ezralow has voting and dispositive power with respect to these shares. |

| 7) | Consists of shares held by Sandy Hills BV. According to filings made with the Securities and Exchange Commission, Mr. Van Vlissingen has voting and dispositive power over the shares held by this entity. |

| 10 |

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

On October 24, 2016, our Chief Executive Officer provided a loan of $1,000,000 to our subsidiary Coda Octopus Colmek. The loan provided for 4.5% interest and a repayment date of November 30, 2018. On or around October 31, 2018 we repaid $500,000 plus $87,500 representing interest on the $1,000,000 for the entire loan period. On December 24, 2018, we Company repaid the remaining $500,000 and interest.

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board in its oversight of the integrity of the Company’s financial statements and compliance with legal and regulatory requirements. Management has responsibility for preparing the financial statements and for the financial reporting process. In addition, management has the responsibility to assess the effectiveness of the Company’s internal control over financial reporting. Frazier & Deeter LLC, the Company’s independent registered public accounting firm, is responsible for expressing an opinion on the conformity of the Company’s audited financial statements to accounting principles generally accepted in the United States of America and on whether the financial statements present fairly, in all material respects, the financial position and results of operations and cash flows of the Company.

In this context, the Audit Committee has:

| (1) | reviewed and discussed with management and Frazier & Deeter LLC the audited financial statements and management’s evaluation of the Company’s internal control over financial reporting. | |

| (2) | discussed with Frazier & Deeter LLC the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301, “Communications with Audit Committees.” | |

| (3) | received the written disclosures and the letter from Frazier & Deeter LLC required by applicable requirements of the Public Company Accounting Oversight Board regarding Frazier & Deeter LLC’s communications with the Audit Committee concerning independence, and discussed with Frazier & Deeter LLC that firm’s independence. |

Based on the review and discussion referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2018, for filing with the Securities and Exchange Commission.

Michael Hamilton (Chairman)

Mary Losty

Per Wimmer

| 11 |

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Frazier & Deeter LLC (“Frazier & Deeter”) as our independent registered public accounting firm for 2019. Although stockholder ratification of the appointment of our independent registered public accounting firm is not required by our Bylaws or otherwise, we are submitting the selection of Frazier & Deeter to our stockholders for ratification to enable stockholders to participate in this important decision. If our stockholders do not ratify the Audit Committee’s selection, the Audit Committee may reconsider its selection. Even if the selection is ratified, the Audit Committee may select a different independent registered public accounting firm at any time during the year if it determines that selection of a different firm would be in the best interests of our company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF FRAZIER & DEETER, LLC.

Fees Paid to Independent Registered Public Accounting Firm

Audit Fees. The aggregate fees billed by Frazier & Deeter, LLC, our principal accountants, for professional services rendered for the audit of the Company’s annual financial statements for the last two fiscal years and for the reviews of the financial statements included in the Company’s Quarterly reports on Form 10-Q during the last two fiscal years 2018 and 2017 were $173,470 and $151,506, respectively.

No other fees were billed by or paid to Frazier & Deeter, LLC. during fiscal 2018 or 2017.

Prior to the Company’s engagement of its independent auditor, such engagement is approved by the Company’s audit committee. The services provided under this engagement may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Pursuant to the Company’s Audit Committee Charter, the independent auditors and management are required to report to the Company’s audit committee at least quarterly regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The audit committee may also pre-approve particular services on a case-by-case basis. All audit-related fees, tax fees and other fees incurred by the Company for the year ended October 31, 2018, were approved by the Company’s audit committee.

| 12 |

PROPOSAL 3. ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

Section 14A of the Securities Exchange Act of 1934 enables our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. Specifically, these rules address the information we must provide in the compensation tables and related disclosures included in this proxy statement.

As indicated in the compensation tables included in this proxy statement, we have structured our compensation program to reflect the size of our operations. While we believe that our executive compensation is modest, we design our compensation with a view towards retaining our executives, motivating them to devote their efforts towards profitable growth of our businesses and aligning their interests with those of our stockholders.

Accordingly, the Board recommends that our stockholders vote in favor of the following resolution:

RESOLVED, that the stockholders of Coda Octopus Group, Inc. approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and any related materials disclosed in the proxy statement for the 2019 Annual Meeting.

This is an advisory vote, which means that the stockholder vote is not binding on us. Nevertheless, we value the opinions expressed by our stockholders and will carefully consider the outcome of the vote when making future compensation decisions for our named executive officers.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries to satisfy delivery requirements for proxy statements and annual reports to stockholders, with respect to two or more stockholders sharing the same address, by delivering a single copy of the materials addressed to those stockholders. This process, commonly referred to as “householding,” is designed to reduce duplicate printing and postage costs. We and some brokers may household annual reports to stockholders and proxy materials by delivering a single copy of the materials to multiple stockholders sharing the same address, unless contrary instructions have been received from the affected stockholders.

If a stockholder wishes in the future to receive a separate annual report to stockholders and proxy statement, or if a stockholder received multiple copies of some or all of these materials and would prefer to receive a single copy in the future, the stockholder should submit a request to the stockholder’s broker if the shares are held in a brokerage account or to our Corporate Secretary, Coda Octopus Group, Inc., 3300 S Hiawassee Rd., Suite 104-105, Orlando, Florida 32835, if the stockholder is a record holder. We will send additional copies of the relevant material following receipt of a request for additional copies.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the Exchange Act, our directors, our executive officers, and any persons holding more than 10% of our common stock are required to report their ownership of the common stock and any changes in that ownership to the Securities and Exchange Commission. To our knowledge, based solely on our review of the copies of such reports received or written representations from certain reporting persons that no other reports were required, except as set forth below, we believe that during our fiscal year ended October 31, 2018, no reports relating to our securities required to be filed by current reporting persons were filed late.

Bryan Ezralow and the Bryan Ezralow 1994 Trust were late in their filing of a Form 4 relating to a transaction that took place on October 31, 2018.

We will continue monitoring Section 16 compliance by each of our directors and executive officers and will assist them where possible in their filing obligations.

| 13 |

STOCKHOLDER PROPOSALS

Any stockholder who, in accordance with SEC rules, wishes to present a proposal for inclusion in the proxy materials to be distributed in connection with next year’s annual meeting must submit the proposal to our Corporate Secretary, 3300 S Hiawassee Rd., Suite 104-105, Orlando, Florida 32835. Stockholder proposals for inclusion in our proxy statement for the 2020 Annual Meeting must be received on or before April 1, 2020 and must comply in all other respects with applicable SEC rules.

Any stockholder who wishes to propose any business to be considered by the stockholders at the 2019 Annual Meeting of Stockholders other than a proposal for inclusion in the proxy statement pursuant to the SEC’s rules, or who wants to nominate a person for election to the board of directors at that meeting, must notify our Corporate Secretary in writing and provide the specified information described in our Bylaws concerning the proposed business or nominee. The notice must be delivered to or mailed to the address set forth in the preceding paragraph and received at our principal executive offices no later than March 1, 2019

OTHER BUSINESS

We are not aware of any matters, other than as indicated above, that will be presented for action at the Annual Meeting. However, if any other matters properly come before the meeting, the persons named in the enclosed form of proxy intend to vote such proxy in their discretion on such matters.

Copies of our Annual Report on Form 10-K for the year ended October 31, 20187, including financial statements and schedules thereto filed with the SEC, but excluding exhibits, are available without charge to stockholders upon written request addressed to Corporate Secretary, Coda Octopus Group, Inc., 3300 S Hiawassee Rd., Suite 104-105, Orlando, Florida 32835. The Form 10-K includes a list of exhibits to the Form 10-K. Copies of exhibits will be furnished to stockholders upon written request and upon payment of reproduction and mailing expenses.

Orlando, Florida

July ____, 2019

| 14 |