UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2020

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-38154

CODA OCTOPUS GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 34-200-8348 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

3300 S Hiawassee Rd, Suite 104-105, Orlando, Florida, 32835

(Address, Including Zip Code of Principal Executive Offices)

407 735 2402

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

COMMON STOCK, $0.001 PAR VALUE PER SHARE

Securities registered under Section 12(g) of the Exchange Act:

NONE

| ● | Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X] |

| ● | Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] |

| ● | Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ] |

| ● | Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. |

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| ● | Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X] |

| ● | State issuer’s revenues for its most recent fiscal year: $20,043,810 |

| ● | State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of April 30, 2020 representing the last business day of the registrant’s most recently completed fiscal year: approximately $27,325,000 |

| ● | State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 10,751,881 as of January 28, 2021. |

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

This Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to in this annual report as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to in this annual report as the Exchange Act. Forward-looking statements are not statements of historical fact but rather reflect our current expectations, estimates and predictions about future results and events. These statements may use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “predict,” “project” and similar expressions as they relate to us or our management. When we make forward-looking statements, we are basing them on our management’s beliefs and assumptions, using information currently available to us. These forward-looking statements are subject to risks, uncertainties and assumptions, including but not limited to, risks, uncertainties and assumptions discussed in this annual report. Factors that can cause or contribute to these differences include those described under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we projected. Any forward-looking statement you read in this annual report reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. All subsequent written and oral forward-looking statements attributable to us, or individuals acting on our behalf are expressly qualified in their entirety by this paragraph. You should specifically consider the factors identified in this annual report, which would cause actual results to differ before making an investment decision. We are under no duty to update any of the forward-looking statements after the date of this annual report or to conform these statements to actual results.

| 3 |

Overview

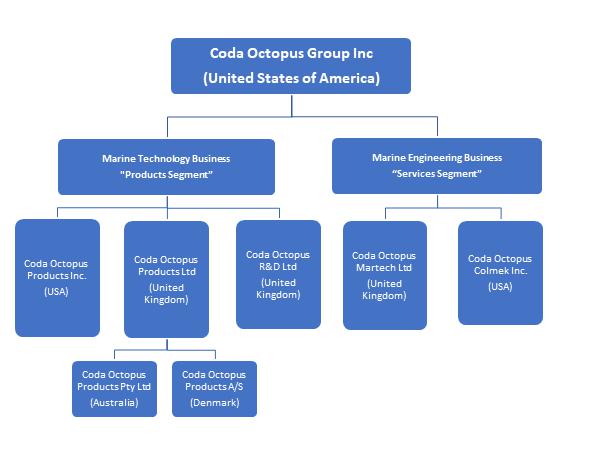

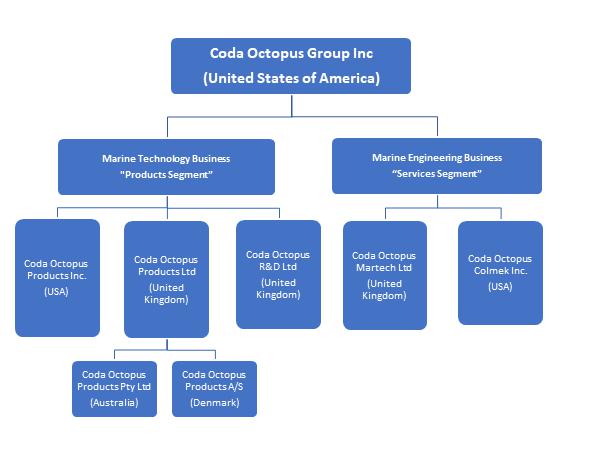

Coda Octopus Group, Inc. (“Coda” “the Company” or “we”), through its wholly owned subsidiaries, operates two distinct businesses:

| ● | the Marine Technology Business (also referred to in this Form 10-K as “Products Business”, “Products Operations” or “Products Segment”); and | |

| ● | the Marine Engineering Business (also referred to in this Form 10-K as “Engineering Business”, “Engineering Operations”, or “Services Segment”). |

Our Marine Technology Business is a technology solution provider to the subsea and underwater market. It owns key proprietary sonar technology used for underwater commercial and defense applications. All design, development and manufacturing of our technology and solutions are performed within the Company. These products and solutions are used primarily in the underwater construction market, offshore wind energy industry (offshore renewables), and offshore oil and gas, complex dredging, port security, mining, fisheries and marine sciences sectors. Our volumetric real time sonar technology is our most promising product for the Group’s growth due to its unique capabilities including real time 3D visualization of moving objects underwater including in zero-visibility water conditions. Our customers include service providers to major oil and gas (“O&G”) companies, renewable companies, underwater construction companies, law enforcement agencies, ports, mining companies, defense bodies, research institutes and universities. We are widely considered the leading solution providers for real time 3D visualization underwater.

Our Marine Engineering Business is a supplier of embedded solutions and sub-assemblies which they design and manufacture and sell into mission critical integrated defense systems such as the Close-In-Weapons System (CIWS). The Services Segment established its business in 1977 and has been supporting a number of significant defense programs for over 40 years, including Raytheon’s CIWS and Northrop Grumman’s Mine Hunting Systems Program. The Services Segment’s business model entails designing sub-assembly prototypes for defense programs which typically lead to contracts for the manufacture, repair and upgrade of these sub-assemblies. We are the sole source for the parts that we supply into these programs. This business model ensures recurring and long tail revenues since we continue to supply parts, typically for the life of the program, which can span decades. Coda Octopus Colmek, Inc. and Coda Octopus Martech Ltd, each qualifies as a small business. This opens up opportunity under state requirements to collaborate with Prime Defense Contractors on these programs.

Due to the above, a significant part of the revenues generated by the Marine Engineering Business is highly concentrated and are derived from a small number of prime defense contractors such as Raytheon or Northrop. In any one year, between 20% to 30% of our consolidated revenues may be derived from these customers either alone or collectively.

The Services Segment operates through our wholly owned subsidiaries, Coda Octopus Colmek, Inc. (“Colmek”) based in Salt Lake City, Utah, and Coda Octopus Martech Limited (“Martech”) based in the United Kingdom.

Our Products and Services operations have established synergies in terms of customers and specialized engineering skills set for robust, rugged and repeated engineering solutions relating to data acquisition, data computation and display of the data. Increasingly drawing on each part of the business strengths, the Marine Technology business and Marine Engineering Business work jointly on projects including responding jointly for tenders.

Our corporate structure is as follows:

Corporate History

The Company began as Coda Technologies Limited. This company now operates under the name Coda Octopus Products Limited, a United Kingdom corporation formed in 1994 as a start-up company with its origins as a research group at Herriot-Watt University, Edinburgh, Scotland. Initially, its operations consisted primarily of developing software for subsea mapping and visualization using sidescan sonar (a technology widely used in commercial offshore geophysical survey and naval mine-hunting to detect objects on, and textures of, the surface of the seabed).

| 4 |

In June 2002, we acquired Octopus Marine Systems Ltd, a UK corporation, and changed our name to Coda Octopus Limited. At the time of its acquisition, Octopus Marine Systems was producing geophysical products broadly similar to those of Coda, but targeted at the less sophisticated, easy-to-use, “work-horse” market. The Octopus Marine Systems acquisition led to the introduction of the Motion product (F180® series) into the Products Segment.

In December 2002, Coda Octopus Ltd acquired OmniTech AS, a Norwegian company, which became a wholly owned subsidiary of the Company and which subsequently changed its name to Coda Octopus R&D AS. OmniTech owned the patents to a “method for producing a 3-D Image” (which has now expired). At the time of acquisition, this company had been engaged for over ten years in developing a revolutionary imaging and visualization sonar technology capable of producing real time three-dimensional (“3D”) underwater images for use in subsea activities. Coda Octopus Products Limited (Edinburgh based) then developed the visualization software to control and display the images from the real time 3D sonar. This patented technology is now marketed by us under the brand name “Echoscope®”. All activities of this now-defunct Norwegian subsidiary have been transferred to Coda Octopus Products Limited (Edinburgh).

On July 13, 2004, the Company effected a reverse merger pursuant to the terms of a share exchange agreement between The Panda Project, Inc. (“Panda”), a Florida corporation, and a now defunct entity affiliated with Coda Octopus Ltd. (“Coda Parent”). Panda acquired the shares of Coda Octopus Limited, a UK corporation and a wholly-owned subsidiary of Coda Parent, in consideration for the issuance of a total of 1,432,143 shares of common stock to Coda Parent and other shareholders of Coda Octopus Limited. The shares issued represented approximately 90.9% of the issued and outstanding shares of Panda. The share exchange was accounted for as a reverse acquisition of Panda by Coda. Subsequently, Panda was reincorporated in Delaware and changed its name to Coda Octopus Group, Inc.

In June 2006, we acquired Coda Octopus Martech Limited which is part of our Services Segment or Marine Engineering Business. This is an English corporation.

In April 2007, we acquired Coda Octopus Colmek, Inc. which is part of our Services Segment or Marine Engineering Business. This is a Utah corporation.

Both Martech and Colmek largely have the same business model, provide similar engineering services and sell to a similar customer base (one is UK focused and the other is US focused).

Coda Octopus Group, Inc., is organized under the laws of the State of Delaware as a holding company that conducts its business through subsidiaries, several of which are organized under the laws of foreign jurisdictions, including England, Scotland, Denmark and Australia. This may have an adverse impact on the ability of U.S. investors to enforce a judgment obtained in U.S. courts against these entities, or to effect service of process on the officers and directors managing the foreign subsidiaries. These companies’ operations must comply with the laws of the countries under which they are incorporated and are likely to be different from the equivalent laws of the United States.

| 5 |

Marine Technology Business (“Products Segment”)

Our Marine Technology Business develops proprietary solutions for both the commercial and defense subsea market. The range of our solutions are complementary and include:

| ● | Geophysical Systems comprising hardware and software; and | |

| ● | Motion and Positioning Systems comprising hardware and software; and | |

| ● | Real Time Volumetric Imaging Sonar comprising hardware and software. |

These products are sold, leased or rented into various marine sectors and include:

| ● | Marine geophysical survey | |

| ● | Underwater construction | |

| ● | Diving | |

| ● | Salvage and decommissioning | |

| ● | Oil and gas | |

| ● | Commercial fisheries | |

| ● | Environmental, mammal and habitat monitoring | |

| ● | Defense | |

| ● | Marine vehicles and robotics | |

| ● | Security, law enforcement and first responders | |

| ● | Research and education |

1. Geophysical Range of Products

Our geophysical systems (“GEO”) range of products include geophysical data acquisition systems, processing and analysis software that are used primarily by survey companies, research institutions, salvage companies and, more recently, offshore energy and renewables operators. These systems are used to survey large areas and create images of the seabed, identify seabed boulders and objects, mark seabed type boundaries and identify existing subsurface structural features, geological layers, and/or buried debris.

2. GPS aided Inertial Positioning Systems

These are referred to as our MOTION range of products and offer high accuracy GPS aided inertial positioning and attitude data, essential for all marine survey applications. The products are commonly bundled with our GEO and real time sonar solutions offering our customers a seamless integration and support experience.

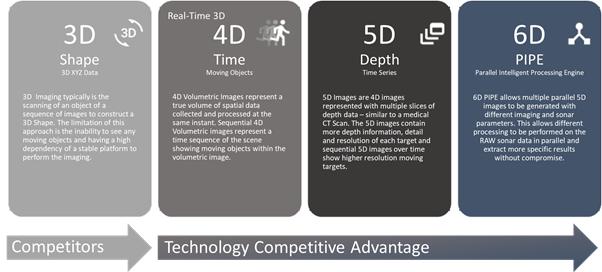

3. Real Time Volumetric Imaging Sonars (ranging from 3D/4D, 5D and 6D)

We design, develop and supply what we believe is the world’s most advanced series of real time volumetric imaging sonar. This is the culmination of over 25 years of research and development. This technology is protected by multiple patents. Furthermore, we continue to file patents relating to our new and revolutionary sonars, our 5-Dimensional (5D) and 6-Dimensional (6D) real time volumetric imaging sonars (marketed under the name Echoscope® PIPE (Parallel Intelligent Processing Engine). Our sonar innovations are multi-tiered and extend to hardware, firmware and software, all of which co-exist and are co-dependent on each other. In other words, hardware, firmware and software operate as sub-systems to each other. We believe that the highly complex nature of this new technology will make it extremely difficult to reverse engineer our products. Pioneering this unique technology gives us a significant advantage over our competitors in the subsea imaging sonar market sectors. We also believe that our three-tier product development capability of hardware, software and solution delivery adds to our competitive lead.

We believe that this technology is superior to the other imaging sonars in the market as it generates real time 3D, 4D, 5D and 6D images of the underwater environment irrespective of low or zero visibility conditions and, unlike conventional sonars, can image a volume (as opposed to a slice of data) and subsea moving objects.

Sonar Hardware

During fiscal 2019, we completed critical innovation and advancement milestones around our core volumetric real time sonar technology. We have now introduced the world’s first 5D and 6D series of volumetric imaging sonar technology. We believe our 5D and 6D series of sonars heralds a significant leap forward in real time subsea imaging as this inventive capability allows a single sonar to provide to different parts of the survey operations multiple real time data sets (as opposed to one 3D dataset) for each part of the survey teams’ requirements.

| 6 |

We believe that our real time volumetric imaging sonar products are revolutionizing the sonar market due to the following unique capabilities:

| A. | Live 3D imaging of any moving objects within the sonar field of view including construction assets, divers, subsea vehicles and tools and machinery executing tasks underwater. |

| B. | Accurate three-dimensional data unaffected by motion or water visibility. |

| C. | Mapping of complex structures with a volumetric ping as opposed to individual angular slices of data. The more complex the structure, the greater the benefit of real-time volumetric sonar imaging over a traditional survey. |

| D. | Live situational awareness of static and moving objects for safe terrain navigation or target tracking. |

| E. | First Person Perspective imaging allowing the operator to point the real-time volumetric imaging sonar towards any target, regardless of where in the water column the target is located and generate a true first person perspective image. |

| F. | Imaging or visualizing subsea environments in low or zero visibility conditions and in situations of high waterflow and active noise pollution (dredging and rock dumping). |

| G. | 3D Range gating of the live image to focus on specific targets or features at specified ranges – regardless of signal strength. This specifically allows for weak targets close to the sonar to be discarded from the image (e.g. bubbles or fish) or detected as threats (e.g. fishing nets). |

| H. | Coherent single sensor delivery for multiple applications. |

| I. | Unique rendering and viewing software techniques that simplifies data interpretation. |

| J. | Direct integration with a range of compatible sensors (e.g. GPS, attitude sensors), actuators (pan and tilt) and custom, task-specific software that provides task or mission solutions for key markets such as the underwater construction market and offshore wind energy sector. |

Prior to January 2018, we were selling our third generation (3G) sonar series. In January 2018 we launched the first product within our fourth generation series of sonars (“4G sonar series”). The 4G sonar series is an important development milestone for the Company. Due to the form factor of our previous generation of 3G sonar series this limited the types of subsea vessels/vehicles this generation of sonar could be integrated on (and therefore be used for) due to (i) size; (ii) weight and (iii) power requirements (“form factor barriers”). With the launch of the 4G sonar series we have removed these form factor barriers and can now integrate on the majority of underwater vehicles in the market including the new and fast emerging smaller underwater vehicles such as autonomous surface vehicles (ASVs) and unmanned underwater vehicles (UUVs) which are propelling growth in the underwater market.

The 4G sonar series developments were largely form factor driven as opposed to being based on performance and capability advancements. In fiscal years 2019 and 2020 we continued our innovation of our sonar technology to focus on performance and capability advancements, particularly on the beamforming and the data processing capability of our sonar series. In the previous generation of our sonars, due to limitations in processing capability technology there were restrictions on how much of the captured sonar data could be processed. Our previous generations of sonars processed 16,384 pieces of data per sonar ping (compared to around 256 pieces of data per sonar ping for competing technology such as the multibeam). Under our new 5D/6D sonars series for each signal that is generated by the sonar we receive back up to 40 million pieces of information which we can now process. We believe that this advancement allows us to deliver to the market the first 5-Dimensional (5D) sonar and 6-Dimensional (6D) sonar capabilities and significantly builds on our 4G sonar series. Our 5D capability allows customers to collect full time series 4D backscatter data in real time. Our 6D capability allows customers to use a single sonar for multiple simultaneous real time data sets using different real time capture and processing parameters (such as range, frequency and field of view).

The 4G sonar series development which we launched in 2018 now combined with the performance and capability advancements (5D and 6D capability) crystalizes the completion of the main pillars of development plans for our real time volumetric sonar series. We believe these achievements are critical milestones in the Company’s growth strategy and also distinguishes our sonar capabilities from all other imaging sonar offerings in the market. This will enable us to refocus a significant part of our spending from R&D to marketing and business development post-Pandemic.

| 7 |

The following diagram outlines the capability summary progression as we transition from our current Real-Time 3D (4D) volumetric imaging sonar system to 5D and then 6D.

Sonar Software

Our software development capability is an important part of our strategy to maintain our lead in designing, manufacturing and selling state-of-the-art real time volumetric imaging sonars.

Our existing third generation (3G) Underwater Survey Explorer software used in conjunction with our real time volumetric sonars, is a product which we have been developing for over 15 years. Because of technological advancements, including access to off the shelf components for more advanced processing of data (speed and size being factors), in 2016, the Company started the process of re-conceiving and developing its top-end software for our now much more advanced sonars. In this connection, in 2019, we launched for customer evaluation our 4th Gen of top-end software for our sonars – 4G Underwater Survey Explorer (“4G USE®”). We have also filed several provisional patents around our 4G USE®.

Our 3G Underwater Survey Explorer software is feature rich and offers advanced processing and application focused capabilities for various markets. 3G USE has been in the market for over 15 years. While this generation of our software is a mature and feature rich product, communication and graphics processing technologies have advanced considerably over recent years, allowing (for example) improved methods for processing larger volumes of data and leveraging new capabilities in recent PC hardware and the GPU.

Our new 4G USE® software is a ground-up development based on the latest processor capabilities and software architecture. 4G USE® will offer a completely new level of real-time visualization and automation processing to complement our recent sonar launches including our 5D and 6D sonars. The initial release of 4G USE® allows multiple devices being utilized simultaneously (example multiple sonars, rotators and inertial and positioning systems) and viewing the real-time data result in a consolidated image. 4G USE® which is also subject to a number of patent applications, is designed as an enterprise class platform, allowing many users access and control of data in real-time for better collaboration, tighter quality control, remote surveying and faster processing.

| 8 |

Our software packages are feature rich and include techniques which are the subject of patents in a number of our modules. In general, our software package contains significant capabilities that are designed to enable surveying a dynamic subsea setting (as opposed to a static mapping of the seabed as is typical for conventional sonar technology). Some of our unique features include:

| Feature Description | Functionality | |

| Real Time Measurements | important for many types of subsea operations such as block or asset placements or aiding diving operations; | |

| Models + Software Module | allows the user to import existing models and engineering drawings into the real time subsea environment; | |

| Edge Detection Algorithm | allows the user to superimpose an edge to easily identify a subsea target; | |

| Rendering a Noise Free Image | allows for a crisp, clear and high-resolution photo-like image without any processing (which would be required for conventional sonars); and | |

| Tracking Algorithm | Algorithm is used to track known objects within the real time 3D Data. This is currently utilized in our Construction Monitoring Software Package (see below) |

Our Echoscope® PIPE (the first 6-Dimensional Sonar) will also bring significant capabilities to include multiple parallel processing (enabling different parameters to be set and utilized) in real time mode. We are not aware of any sonars that can offer this capability. This will allow multiple tasks and users of the real time data simultaneously, thus increasing efficiency and enabling tasks which were previously impossible.

Geophysical Products and Solutions

We started our business in 1994 designing and developing the CodaOctopus® GeoSurvey software and hardware package for acquisition and processing of sidescan sonar and sub-bottom profiler data. For over two decades, our GeoSurvey has been an industry leading software package in the market for data acquisition and interpretation and provides feature rich solutions and productivity enhancing tools for the most exacting survey requirements. Designed specifically for sidescan and sub-bottom data acquisition, CodaOctopus® GeoSurvey has been purchased by numerous leading survey companies throughout the world.

The Products Business generates around 5% of its revenues from this range of products. With the launch of the new products based on Artificial Intelligence technology for which we believe there is increased demand we would anticipate our revenues from this line to increase over time.

Geophysical Hardware

These consist of a range of hardware solutions for field acquisition of sidescan sonar and sub-bottom profiler, which includes analog and digital interfaces compatible with all geophysical survey systems.

In 2018, we introduced our DA4G-USB product. This allows customers to integrate the DA4G hardware into their own PC configuration. Based on the CodaOctopus® DA4G system, it offers the same functionality, robustness and ease of use. CodaOctopus® DA4G is the 4th generation of our successful DA series and is built on twenty years of knowledge, experience and innovation in supplying unparalleled products and service to the worldwide geophysical survey sector. These purpose-built, turn-key, systems incorporate the very latest hardware specifications and are designed and delivered to meet the demanding nature of offshore survey work.

The CodaOctopus® DA4G range consists of a number of options and is backed (like all our products) with global service and support.

This consists of an integrated suite of software that automates the tasks of analyzing, annotating and mosaicing complex data sets, thus ensuring faster and more precise results.

Geophysical Software

Our CodaOctopus® GeoSurvey software is supplied to complement our DA4G hardware, offering field acquisition of sidescan sonar and sub-bottom profiler data.

Our Survey Engine software product offers a more advanced post-processing solution for sidescan sonar and sub-bottom profiler data. Designed to streamline processing of very large data sets – many 100GBs – it offers comprehensive processing, interpretation, visualization, reporting and exporting functionality.

We continue to advance this range of products and in 2018 we launched our first product based on Artificial Intelligence techniques which allows us to automatically identify boulders on the seabed (“Survey Engine Automatic Object Detection (SEADP)”). This new product presents a real opportunity to radically change workflow process for post-processing and analyzing side scan sonar data to assess, among other things, the suitability of an area for exploration and construction activities (O&G installations, pipeline and cable laying activities). This is in its early stage of roll out and has sparked significant interest. This is an area where we are investing our research and development efforts.

| 9 |

Additionally, in 2019 we introduced our Seabed Classification module (again based on Artificial Intelligence techniques). This automatically classifies sidescan sonar imagery into different seabed types, computes and exports polygonal boundaries for these areas, and thereby simplifies sidescan processing.

Inertial Positioning and Attitude Measurement Systems (“Motion Products”)

Our Motion Products are Global Navigational Satellite System (referred to in the industry as “GNSS” Aided Inertial Measurement Units) provide measurement data on the position and attitude of a vessel. This device provides real-time data on these measurements which are applied to compensate for vessel movement in order to align sonar data and remove motion blur.

We have had our F180® series in the market for over 15 years. These systems are used either alone and then paired with third parties multibeam sonars or used in conjunction with our volumetric real time sonars. This technology has been developed for the marine environment and is based on technology originally developed for the extreme world of motor racing. Modifications and enhancements have resulted in a simple-to-use, off-the-shelf product that brings accurate positioning and motion data into extreme offshore conditions for precision marine survey applications worldwide. Variants within the F180® series include the F190, exclusively configured for use ‘near-land’, e.g., within ports and harbors, and the F185, with enhanced precision positioning to 1cm accuracy (<0.5”). Coda Octopus iHeave, an intelligent software product for dealing with long period ocean swell compensation, is fully integrated within the F180® series.

New Generation of Motion Products

We have now completed the ground up development of our new generation of Motion Products (F280®). The new F280 is based on more advanced technology, more accurate than our F180® series. The new technology is much more scalable towards future development of new product variants. The F280® series is highly complementary to our real time volumetric sonar series and they are packaged together to provide a more comprehensive solution to our customers. The F280 is sold with and without our sonar series.

Sales and Marketing

We market our products primarily through our website, industry events, webinars and industry relationships. We also have an internal sales and marketing team which is engaged in marketing and selling our products. In addition, we have a network of non-exclusive independent global sales agents.

Coda Octopus Products Limited has the requisite accreditations for its business including being Lloyds Register accredited to ISO 9001:2015 and Cyber Essentials certification.

| 10 |

Marine Engineering Businesses (“Service Segment”)

Our Marine Engineering Businesses comprise Coda Octopus Colmek, Inc. based in Salt Lake City and Coda Octopus Martech Limited based in the United Kingdom.

These two operating entities supply engineered sub-assembly solutions which form part of mission critical integrated defense systems, test equipment, instrumentation and the like. They operate as sub-contractors to prime defense contractors and their engineering solutions are typically within broader defense programs where high levels of reliability and quality are essential pre-requisites for securing and maintaining these agreements with their customers. Typically, we prototype products for these customers and after going through various acceptance tests, including first article inspection approvals, we are given the production contracts. Many of these production contracts have a repeat orders profile which typically follows the life cycle of the defense program that is using the production part.

These arrangements often give us long term preferred/sole supplier status for the parts we supply, technology refresh and obsolescence management business opportunities with these customers and we generally use these long-standing relationships to win more contracts with these customers.

This business relies on increasing the number of new programs it attracts annually.

In addition, we are increasingly combining our engineering capabilities with our product offerings. This enables us to offer systems which are complete with installation and support to maximize the utilization of our collective expertise to advance our real time volumetric sonar technology.

Coda Octopus Martech Limited (“Martech”)

Martech operates in the specialized niche of bespoke design and manufacturing services mainly to the United Kingdom defense and subsea industries. Its services are provided on a custom sub-contract basis where high quality and high integrity devices are required in small quantities.

The Company enjoys pre-approvals to allow it to be short-listed for certain types of government contracts. Much of the more significant business secured by Martech is through the formal government or government contractor tendering process. Government contracts may be terminated at any time at the discretion of the government. If the government does terminate a contract, the Company is allowed to recover the costs incurred up to the date of termination. During the last few years, only one non-material government contract was terminated for convenience.

| 11 |

Coda Octopus Colmek, Inc. (“Colmek”)

Colmek is a service provider of defense engineering solutions, particularly in the fields of data acquisition, storage, transmission and display. It has grown and diversified since beginning its operations in 1977 and now provides services and products to a wide range of defense, research and exploration organizations in the United States.

It designs, manufactures and supports systems that are reliable and effective in multiple military and commercial applications where ruggedness and reliability under extreme operational conditions are paramount and where lives depend on accurate and precise information.

Colmek has long standing relationships with a number of prime defense contractors and has been supporting a number of defense programs for over 40 years including the Close in Weapons Support Program (CIWS) for which it supplies proprietary parts and services and technical refresh programs. As a result, Colmek has recurring revenues from these long-standing programs. Colmek continues to expand the number of established programs into which it supplies proprietary parts.

In June 2014 Colmek completed the acquisition of the Thermite® which is a rugged visual mission computer line and the Sentiris® AV1 XMC video card for $1,100,000 in cash. Colmek also acquired hardware, Thermite inventory and other intellectual property rights (such as software code and trademarks pertaining to these products). Thermite® was acquired with the goal of updating the technology and expanding the market for this rugged mission computer.

The Thermite® Product fits within established programs with Department of Defense (“DoD”) prime contractors and benefits from being a single source product under this program. Customers for this item include the US Army, Benchmark, and Endeavor Robotics Defense and Security Division.

Thermite ® Rugged Visual Computers

| ● | Rugged, graphics-based PCs designed to perform in the most brutal environmental conditions; | |

| ● | Focus on graphics-based high-performance computing with integrated accelerated video capture capability; | |

| ● | Lightweight, power efficient and conduction-cooled; | |

| ● | Three models optimized for man-wearable, vehicle, and airborne platforms; and | |

| ● | Programs include dismounted soldier training, mission rehearsal, real time imaging, robotic control, weapon system control, sensor processing and display. |

| 12 |

We consider Thermite® to be an important part of our growth strategy and are investing in the new generation of these mission computers and have expended significant development costs on re-engineering this. To this end, we have now designed and developed our next generation of the Thermite® “Octal”. The new Octal is in trials with a number of new customers who fit the profile of large quantity purchasers with repeat and long-term requirements for this product. The coronavirus Pandemic has interrupted the completion of these trials. The Thermite is one of our key growth catalysts.

Other products offered by Colmek include subsea telemetry and data acquisition systems, rugged workstations, analog-to-digital converters and rugged LCD displays.

Competition

In our Products Segment, we are exposed to the following competitive challenges:

Data Acquisition Products (GEO Products)

The sonar equipment industry is fragmented with several companies occupying niche areas, and we face competition from different companies with respect to our different products. In the field of geophysical products, Triton Imaging Inc., a US-based company, now part of the ECA Group (Toulon, France), Chesapeake, a US-based company, and Oceanic Imaging Consultants, Hawaii, USA, dominate the market with an estimated 25% each of world sales, while we believe that we control approximately 5% of world-wide sales.

| 13 |

Inertial Positioning and Attitude Measurement Systems (“Motion Products”)

In the field of motion sensing equipment, where our product addresses a small part of the overall market, we believe that we have four principal competitors: TSS (International) Ltd in Watford, England which is focused on the mid-performance segments with about 25% of the world market; Ixsea, a French company which covers all segments, with about 20% of the market; Kongsberg Seatex, a Norwegian company (part of Kongsberg Gruppen) which has products across all segments, with about 15% of the market; and Applanix, a Canadian company, now part of Trimble which has one major product focused on the high end of the market, with about 20% of the market. We believe that our market share in the field of motion sensing equipment is only about 5%. This market is fiercely competitive and with the advancement of technology, there are new entrants to the market such as SBG Systems (a French based manufacturer of motion sensors). Due to the price pressure in this market, we are selling our products more in conjunction with our real time 3D sonars than on a standalone basis. However, with the development of our new F280®product, this gives us the opportunity to increase our market share.

Real Time Volumetric Sonar

In the field of Real Time 3D/4D/5D imaging, we are unaware of other companies offering a similar product. The entry into this market is dependent upon specialized marine electronics, acoustic and software development skills. The learning curve, which has resulted in the advancement of our real time 3D sonar device, is the culmination of two decades of research and development into this field. Companies such as Tritech International Ltd., United Kingdom, BlueView Technologies Inc., USA (now a part of Teledyne Technologies Incorporated), and Norbit Group AS Norway are examples, but none of these sonar offerings are directly comparable or competitors to our real time volumetric sonar solutions. Specifically, we believe that they do not have the same capabilities as our Echoscope® technology in terms of generating real time 3D, 4D, 5D and 6D images of moving objects underwater including in environments in low or zero visibility conditions. Nor the ability to use a single sonar for multiple real time 3D images simultaneously. Notwithstanding it should be noted that Teledyne has acquired a significant number of substantial subsea companies (examples are Reson and BlueView). Teledyne has much greater resources, liquidity and market reach than our Company and has many operating verticals. We therefore can give no assurance that companies such as these will not enter this market. Notwithstanding, we believe that our recent development and introduction of 5D/6D - Echoscope PIPE®) sonar capability further distinguishes our volumetric sonars and significantly extends our lead over competitors in the subsea imaging market. We are not aware of any other imaging sonars in the market capable of generating real time 5D and 6D imagery underwater. The innovations around Echoscope PIPE® are the subject of numerous patent applications.

We seek to compete on the basis of producing high quality products employing cutting edge technology that is easy to use by operators without specialized skills in sonar technology. We intend to continue our research and development activities to continually improve our products, seek new applications for our existing products, to develop new innovative products and grow the market for our products and expertise.

In our Services Segment, we are exposed to the following competitive challenges:

Marine Engineering Businesses

Through our marine engineering operations, Coda Octopus Colmek, Inc. and Coda Octopus Martech Limited, we are involved in custom engineering for the defense industry in the United States and in the United Kingdom. Martech competes with larger contractors in the defense industry. Typical among these are Ultra Electronics, BAE Systems, and Thales, all of whom are also partners on various projects. In addition, the strongest competitors are often the clients themselves. Because of their size, they often have the option to proceed with a project in-house instead of outsourcing to a sub-contractor like Martech or Colmek.

Intellectual Property

Our product portfolio and technologies are protected by intellectual property rights including trademarks, copyrights and patents. In the last 2 years we have advanced our existing sonar technology and have filed a number of significant patents applications pertaining to these inventions including covering our newly innovated 5D and 6D sonars.

Patents

Our patented inventions along with our strategy to enhance these inventions are at the heart of the Company’s strategy for growth and development.

| 14 |

Our patent portfolio consists of the following:

| Patent Number | Description | Expiration Date | ||

| US Patent No. 7,466,628 | Concerns a “Method of constructing mathematical representations of objects from reflected sonar signals.” | January 1, 2027 | ||

| US Patent No. 7,489,592 | Concerns a “Method of automatically performing a patch test for a sonar system, where data from a plurality of overlapping 3D sonar scans of a surface, as the platform is moved, are used to compensate for biases in mounting the sonar system on the platform”. | July 8, 2027 | ||

| US Patent No. 7,898,902 | Concerns a “method of representation of sonar images” allowing sonar three-dimensional (3D) data to be represented by a two-dimensional image. | June 13, 2028 | ||

| US Patent No. 8,059,486 | Concerns a method of rendering volume representation of sonar images. | April 16, 2028 | ||

| US Patent No. 8,854,920 | Concerns a method of volumetric rendering of three-dimensional sonar data sets | June 22, 2033 | ||

| US Patent No. 9,019,795 | Concerns a method of object tracking using sonar imaging | November 30, 2033 | ||

| US Patent No. 10,088,566 | Concerns a method of object tracking using sonar imaging | November 26, 2036 | ||

| US Patent No. 10,718,865 | Concerns a method of compressing beamforming sonar data | March 1, 2039 | ||

US Patent No. 10,816,652 |

Concerns a method of compressing sonar data |

October 28, 2038 | ||

| JP Patent No. 5565964 | To provide a method for drilling/levelling thereof by an Underwater drilling/levelling work machine construction device | January 31, 2031 | ||

| JP Patent No. 5565957 | To Provide a construction management method by a three- dimensional Sonar by a construction management device | October 31, 2030 |

Trademarks

We own the registered trademarks listed below and they are used in conjunction with the products that we market and sell:

Coda®, Octopus®, CodaOctopus®, CodaOctopus & Design®, Octopus & Design®, F180®, F280®, F280 Series®, Echoscope®, Echoscope 4G®, Echoscope 5D®, 5D Echoscope®, Echoscope 6D®, 6D Echoscope®, Echoscope PIPE® Ping-Pong Echoscope Sonar®, Ping-Pong Echoscope®, Ping-Pong Sonar®, 4G Underwater Survey Explorer®, 4G USE®, Survey Engine®, Dimension®, DAseries®, CodaOctopus® Air, CodaOctopus® Vantage; CodaOctopus® UIS; CodaOctopus® USE, Sentiris® and Thermite®.

In addition, we have registered several internet domain names including www.codaoctopus.com; www.codaoctopusgroup.com; www.colmek.com and www.martechsystems.co.uk.

Research and Development

Research and Development is foundational to our business strategy to ensure our growth strategy and maintain our competitiveness. During the fiscal years ended 2020 and 2019, we spent $3,188,389 and $2,801,331 (a 13.8% increase), respectively, on Research and Development. With the crystallization of our sonar series developments and our F280® inertial navigation system, we would expect R&D expenditures in this area to be less in 2021 fiscal year.

Our products are complex and therefore we can give no assurance that even with spending a significant part of our resources on R&D, we will be successful in our development goals. Furthermore, even following launch of any product we may not succeed. Moreover, we may incur significant research and development expenditures without realizing viable products.

| 15 |

Government Regulation

Because of the nature of some of our products, they may be subject to export control regimes including in the United States, United Kingdom, Denmark and Australia where we conduct business operations. Where our products are subject to such export control requirements, they may only be exported to our customers if there is a valid export license granted by the relevant government body. Moreover, these regulations may change from time to time in these jurisdictions, including the United States, depending on the existing relationship with the country to which the goods are exported. See Item 7 (Management’s Discussion and Analysis of Financial Condition and Results of Operation) for further discussion on this.

We are also required to maintain certain accreditations such as ISO accreditation, cyber security certifications, approvals to hold government items or materials and/or certain personnel or facility clearances.

In addition, as a provider for the US Government, we may be subject to numerous laws and regulations relating to the award, administration and performance of US Government contracts, including the False Claims Act. Non-compliance found by any one agency could result in fines, penalties, debarment, or suspension from receiving additional contracts with all US Government agencies. Given our dependence on US Government business, suspension or debarment could have a material adverse effect on our business and results of operations.

Employees

As of the date hereof, we employ approximately 110 employees worldwide, of which 12 hold management positions. A large majority of our employees have a background in science, technology and engineering, with a substantial part being educated to degree and PhD level. None of our employees are employed under a collective agreement and we have not experienced any organized labor difficulties in the past.

Not required for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

| 16 |

Orlando, Florida

Our corporate offices are co-located with our subsidiary Coda Octopus Products, Inc. in Orlando. We own these business premises comprising 3,000 square feet that includes office space and R&D facilities.

Salt Lake City, Utah, USA

Coda Octopus Colmek operates from its premises which comprises 16,000 square feet and includes production, R&D Facilities and office space. These premises are owned by Coda Octopus Colmek.

Edinburgh, Scotland, UK

Coda Octopus Products Limited (Edinburgh based) operates from its premises comprising 12,070 square feet of internal space and includes production, R&D Facilities and office space. These premises are owned by Coda Octopus Products Limited.

Copenhagen, Denmark

As a mitigation strategy in relation to the UK leaving the European Union membership, thus limiting trade relations with EU member states, we have leased business premises in Copenhagen, Denmark. The lease runs from September 1, 2019 to September 1, 2023 with a clause allowing us to break the lease with effect from September 1, 2021 upon 6 months’ notice.

Annual rent is DKK 131,625 plus Value Added Tax (being an equivalent of $19,660 per annum) with an annual increase of 3%.

Portland, Dorset, UK

Martech uses premises owned by Coda Octopus Products Limited. These premises are located in the Marine Center in Portland, Dorset, United Kingdom, and comprise 9,890 square feet. The building comprises both office space and manufacturing and testing facilities. The lease is on a rent-free basis for a period of 2 years expiring December 31, 2020. After this Martech will resume paying Coda Octopus Products Limited rent amounting to the equivalent of $56,457 per annum.

All non-US Dollar denominated rents are stated according to prevailing exchange rates as of the date of each respective lease agreement.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings that we believe will have, individually or in the aggregate, a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

| 17 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock has been traded on the Nasdaq Capital Market under the symbol “CODA” since July 19, 2017. Prior thereto, it had been quoted on the OTCQX since February 8, 2017 under the symbol COGI, and prior thereto, on the OTC Pink Sheets under the symbol CDOC. The following table sets forth the range of high and low bid prices of our common stock as reported and summarized on the Nasdaq, for the periods indicated. These prices are based on inter-dealer bid and asked prices, without markup, markdown, commissions, or adjustments and may not represent actual transactions.

| Year Ended October 31, 2020 | HIGH | LOW | ||||||

| First Quarter | $ | 9.26 | $ | 6.29 | ||||

| Second Quarter | $ | 7.04 | $ | 4.63 | ||||

| Third Quarter | $ | 6.17 | $ | 4.41 | ||||

| Fourth Quarter | $ | 6.73 | $ | 5.42 | ||||

| Year Ended October 31, 2019 | HIGH | LOW | ||||||

| First Quarter | $ | 6.86 | $ | 5.23 | ||||

| Second Quarter | $ | 15.30 | $ | 5.91 | ||||

| Third Quarter | $ | 18.97 | $ | 9.71 | ||||

| Fourth Quarter | $ | 11.66 | $ | 7.16 | ||||

We have not declared or paid any cash dividends on our common stock, and we currently intend to retain future earnings, if any, to finance the expansion of our business, and we do not expect to pay any cash dividends in the foreseeable future. The decision whether to pay cash dividends on our common stock will be made by our board of directors, in their discretion, and will depend on our financial condition, operating results, capital requirements and other factors that the board of directors considers significant.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

| 18 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OPERATIONS

Forward-Looking Statements

The information herein contains forward-looking statements. All statements other than statements of historical fact made herein are forward looking. In particular, the statements herein regarding industry prospects and future results of operations or financial position are forward-looking statements. These forward-looking statements can be identified by the use of words such as “believes,” “estimates,” “could,” “possibly,” “probably,” anticipates,” “projects,” “expects,” “may,” “will,” or “should” or other variations or similar words. No assurances can be given that the future results anticipated by the forward-looking statements will be achieved. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Our actual results may differ significantly from management’s expectations.

The following discussion and analysis should be read in conjunction with our financial statements, included herewith. This discussion should not be construed to imply that the results discussed herein will necessarily continue into the future, or that any conclusion reached herein will necessarily be indicative of actual operating results in the future. Such discussion represents only the best present assessment of our management.

General Overview

We operate two distinct business operations. These are:

| ● | the Marine Technology Business (also referred to in this Form 10-K as “Products Business”, “Products Operations” or “Products Segment”); and | |

| ● | the Marine Engineering Business (also referred to in this Form 10-K as “Engineering Business”, “Engineering Operations”, or “Services Segment”). |

Our Marine Technology Business is a technology solution provider to the subsea and underwater market. It has a long-established pedigree in this market, and it innovates, designs, develops and manufactures proprietary solutions for this market (both for commercial and defense applications) including our range of flagship volumetric real time sonar solutions.

These solutions and products are used primarily in the underwater construction market, offshore oil and gas, offshore wind energy industry, and in the complex dredging, port security, mining and marine sciences sectors. Our customers include service providers to major oil and gas (“O&G”) companies, law enforcement agencies, ports, mining companies, defense bodies, fisheries and research institutes.

Our Marine Engineering Business is a supplier of engineering services and embedded solutions (such as mission computers) to prime defense contractors such as Raytheon and Northrop Grumman. Generally, the items supplied into the defense market are sub-systems in broader mission critical integrated systems and thus requires a high level of reliability, consistency in standards and robustness.

We have long-standing relationships with prime defense contractors, and we use these credentials to secure more business. We support some significant defense programs by supplying and maintaining proprietary parts (or parts for which we are preferred suppliers) through obsolescence management programs. These services provide recurring stream of revenues for our Services segment.

| 19 |

Both the Marine Technology Business and Marine Engineering Business have established synergies in terms of customers and specialized engineering skill sets (hardware, firmware and software) encompassing capturing, computing, processing and displaying data in harsh environments.

Our business is affected by a number of factors including those set out below:

| A. | United Kingdom’s withdrawal from the European Union (“Brexit”) |

The UK was a member of the European Union member states for close to 50 years. This membership enabled the freedom of movement of goods, persons, capital and services between member states. Following a referendum in 2016 where the country voted to leave the EU, the UK withdrew from its membership of the EU on December 31, 2020. This withdrawal removed these rights.

As part of the withdrawal, the UK Government and EU reached an agreement on December 30, 2020 on trade in certain areas. At this stage there is scant analysis available on the details of the trade agreement concluded between the parties. However, from the information available we understand that for the solutions and products we supply to the EU member states, there will be no trade tariffs or quotas (applicable at this stage).

However, the change in the UK EU membership status still adversely impacts our business in a number of important areas:

| ● | We will not be able to recruit workers from the EU member states without getting a work permit. | |

| ● | Our technology requires training to support its effective implementation. Typically for sales and rentals we would mobilize our engineers to train and assist these customers in set up of the equipment. Under the new trade agreement, we will need to obtain the necessary work permits from the EU member state to which we intend to send our engineer. This will be time consuming and costly and the rules for granting such permit will vary from member state to member state. Furthermore, we have no precedent to know if these permits will be granted. | |

| ● | We are now subject to custom procedures for exporting our goods to EU member states. Furthermore, the introduction of border controls, where the infrastructure is not in place to support the expeditious movement of vehicles across border, could result in delays of exports and supply chain delays, which could impact on our ability to manufacture our products and meet customer demand in a timely manner. |

Since there is scant detailed analysis available on the recently concluded trade agreement between the UK and the EU, including preconditions, reservations and exclusions that may be present, the full implications for the Company are, at this stage, not completely clear.

The Company established a company, Coda Octopus Products A/S, in Denmark to maintain a presence in the European Union and to address some of the foreseeable issues. Even with the trade deal in place, this subsidiary is still considered important for the Company.

| 20 |

| B. | Currency Risks: |

The Company’s operations are split between the United States, United Kingdom, Denmark and Australia. A large proportion of our revenues (approximately 47%) and costs are incurred outside of the USA with a significant part (46% of our total revenues) of that in the United Kingdom (“UK”). In addition, a significant part of our assets (both current and fixed) is held in British Pounds by our foreign subsidiaries. Significant currency fluctuations (particularly the British Pound versus the US Dollar) may affect our financial results and the value of our assets. With the conclusion of the trade agreement between the UK and EU, we anticipate that unlike the last 4 years which saw increased volatility between the British Pound and other major currencies, including the US Dollar, it will be more stable.

| C. | Impact of Coronavirus Outbreak (referred to in this Form 10-K as “Coronavirus”, (“Pandemic”) or (“COVID-19”) |

General Impact

The global outbreak of the Coronavirus has resulted in governments throughout the world, implementing measures restricting the freedom of movement of people and curtailment of business activities including business closure to curb the spread of the coronavirus.

Our business started to be impacted in February 2020 when several significant industry events such as trade shows important for the promotion and marketing of our products were cancelled. In addition, several navy projects which had been scheduled for implementation were indefinitely postponed in February 2020. During March 2020, governments introduced “global restrictions of movement” that impacted our ability to conduct much of our income generating business activities. Our financial performance was materially impacted in the second quarter of 2020. In the Third Quarter we saw improvement in market conditions. However, in the Fourth Quarter with the resurgence of the so-called “second wave”, our operations were once again hampered with various degrees of closure of the business or reduction in activities to comply with Government regulations or to perform company-wide COVID-19 tests, all of which resulted in substantial fall in business productivity, the decline of revenues in the Fourth Quarter of our fiscal year along with increased costs of operation associated with our Pandemic response. The Pandemic has affected the industry in which our businesses operate in and has resulted in reduced demand for our goods and services in the 2020 FY resulting in a material fall in our revenues with total operating expenses remaining at the same level thus resulting in a fall in our net earnings in the 2020 FY.

In January 2021, the UK Government imposed the highest level of restrictions limiting business operations. Our UK Business is therefore affected and will largely remain closed for the months of January and February 2021. Since we are a manufacturing company, it is increasingly difficult and not financially viable to institute remote working.

Impact on Revenues and Earnings

Until the business environment normalizes, we are uncertain as to the extent of the impact the coronavirus outbreak will have on our future financial results. In the 2020 FY we have experienced three full quarters of the coronavirus impact and our financial results have been negatively impacted as we are seeing less demand for our goods and services and at the same time increased costs associated with managing the Pandemic response in the Company. Furthermore, the ability to continue to implement projects successfully is impacted by rules requiring staff to quarantine (which can be for many weeks). This is further compounded by the size of our business, where often, key functions are concentrated in a small team of staff members who may all be affected by this issue at the same time.

On the Products Business side, a significant part of our revenues is generated from field customer support work (training, assistance in mobilization of equipment or operating the equipment on behalf of our customers). Coronavirus has caused many of these field projects to be postponed indefinitely – which in turn negatively affects our revenues and financial results. This is evident in our rental income which is down by 51.5% in the 2020 FY over the 2019 FY. We believe that travel will not be normalized for much of 2021 and therefore we believe that we will continue to be impacted by the Pandemic (even with the vaccination program now being implemented).

| 21 |

On the Services Business side, travel is also an important element as many of its engineering projects require customers to attend its premises to conduct Critical Design Reviews (“CDRs”). The Coronavirus outbreak has resulted in travel restrictions due to customers’ policy or quarantine requirements. This in turn has resulted in the delay in many engineering projects, thus negatively impacting our revenues and financial results. This business is also affected by the same business interruptions caused by requirements for staff members to self-isolate and this may be an entire team, affecting our ability to operate the business and perform customer projects. It has also dampened demand for our services as many purchasing decisions have been deferred due to many Government employees’ working from home making it difficult to take these decisions in accordance with their practices.

Government Policies on Coronavirus

Our operations are based in a number of countries, with each country establishing different rules related to coronavirus including rules on restricting business operations, limiting staff travel work and quarantining rules. This has generally resulted in a much less predictable working environment for planning and delivering customer projects and project cost management. Several implications flow from this including:

| ● | Impairment of the business’ productivity | ||

| ● | Project over runs | ||

| ● | Increased operation costs resulting from our Pandemic response | ||

| ● | Increase project costs due to the delay caused by self-isolation rules or business closure or restriction on travel to work | ||

| ● | Higher staff costs due to increased sick pay allowance which varies according to the country where the business operations are located, combined with lower overall productivity. |

Impact on Liquidity, Balance Sheet and Assets

Failure to curb the coronavirus Pandemic in the near future, coupled with a downturn in the global economic outlook, may adversely impact on our availability of our free cashflow, working capital and business prospects. As of October 31, 2020, we had cash and cash equivalents of approximately $15.1 million and for the year then ended we generated approximately $4.4 M of cash from operations. Based on our outstanding obligations including loans and notes payable, their terms and our cash balances we believe we have sufficient working capital to effectively continue our business operations for the foreseeable future.

Products Business Outlook

In the 2020 FY the Products Business revenues fell by 12.6% compared to the previous 2019 FY. This was largely due to the business interruption caused by the coronavirus outbreak and the restrictive measures put in place by various governments to contain the virus.

The coronavirus outbreak started to impact our business at the beginning of the second quarter of the current fiscal year (February 2020). The outbreak has limited the number of offshore projects which are undertaken by our customers. This has resulted in a significant fall in the category of revenues relating to project work (rentals) which fell in the 2020 FY by 49.4% and was $1,361,151 compared to $2,688,570 in the 2019 FY. In addition, we have seen a reduced demand for our products and services, which are attributed to the Pandemic, its impact on spending by our customers and also change in policy of the United Kingdom and USA Government concerning exporting of our products to China. In the current fiscal year, we have had the equivalent of $1,300,000 of orders intended for China refused by the UK Government. This is material for our business.

The Products Business operations are global and much of our income generating activities require us to attend customer sites, often on an offshore vessel. Offshore activities now require more planning to ensure personnel entering the offshore facility are virus-free. The new norm requires personnel to be quarantined for a 14-day period in the country where the job site is located, prior to entering the vessel. This limits available resources for customer projects (as project implementation time is likely to increase by the 14 days arrival quarantine and the additional 14 days upon return to home country). It also increases the costs of executing these projects.

A significant part of the Products Business human capital and resources are based in the UK. The UK Government has introduced a tiered system to manage the coronavirus outbreak in various regions of the UK. In January 2021, the Scottish Government moved to the highest levels of restrictions which introduced a national lockdown for the period of January. This restricts our ability to operate the business and we anticipate that this will adversely affect our revenues.

| 22 |

A substantial part of our revenues is generated by our UK operations. With the UK leaving the European Union, we believe that we will realize less sales from the EU member states countries.

We rely on specialist software development skills. There is an acute shortage of these skills which has resulted in reduced resourcing of these skills in our business and at the same time significantly increased costs associated with securing these skills. This could impact our ability to service and develop our products and/or serve to increase our overall costs, and therefore impact on our financial results.

We rely on sophisticated electronics for our products and we anticipate delay in the supply chain and increase in price. This may affect, among other things, our gross margins and ability to fulfill customer orders in a timely manner along with a resulting decline in revenues.

Services Business Outlook

In the 2020 FY the Services Segment revenues fell by 27.8% compared to FY 2019.

This is due to the impact of the coronavirus outbreak which has resulted in reduce demand for our services. In addition, our engineering projects require customers to attend our sites for Critical Design Reviews (“CDRs”). Due to the policy of many organizations to limit travel to “essential travel only”, many CDRs are postponed and this negatively impacts on the advancement of the engineering projects which will impact revenues. The Services Business is likely to continue to be impacted until the curtailments caused by the coronavirus are removed.

The Services Business is also impacted by the change in the US Administration. This will result in a delay in approving the budget and making the appropriations. In addition, there may be changes in the Government’s Defense Spending priorities which could affect the programs that use our products. This could be further compounded where the new Administration in the Senate is operating on a slim majority – which may result in further delays in the finalization of the Federal Defense Budget.

| D. | Political Landscape/Exporting to China |

We sell our products globally and increasingly to Asia. The recent change in both the US and UK Governments attitude towards trade with China, directly affects the sale of our products to customers based in China. Our real time 3D sonars which are rated above 300 meters along with our inertial navigation and attitude measurement sensors (F280® series) are subject to export control for certain countries, including China.

Recently the US Government Department of Commerce (Bureau of Industry and Security) amended the Export administration Regulations (EAR) to add seventy seven (77) Chinese entities “determined ….to be acting contrary to the national security or foreign policy interests of the united States”. The amended EAR in general states that there is a “presumption of denial” of grant of export licenses to these entities and their affiliates.

The UK Government is generally in step lock with the US Government’s position and recently, refused to grant export licenses for several applications for end users in China for the first time in 25 years of our dealing with the UK Export Control Organization. The curtailment of access to this market due to refusal to issue export licenses is likely to significantly impact our revenues from Asia.

Furthermore, even though our sonars which are rated at 250m or less do not require export licenses for China, the UK Customs are now seizing these items which are destined for China.

In 2020 FY we were unable to meet demand for $1,300,000 of sales order for China, due to refusal by the UK Government to issue export licenses.

The removal of China as a trading partner is likely to have significant negative impact on our revenues and growth strategy. China has one of the largest planned investment programs for offshore renewables, the market which most of our technology is used for in China. After significant business development in China, we had started to see persistent and credible growth for our products in this market. Unless there is a change in this policy, we are likely to see a decline in growth and sales into the Chinese Market. It is estimated that around 50-75 multibeam sonars are sold to China Commercial Market each year (approximately $10 million). It is this market we had started to make significant inroads in to increase our global market share. Unless the Government’s current policy/stance changes and becomes favorable to resumption of trade with China, we are unlikely to realize this potential, imminently.

| 23 |

| E. | Price of Commodities and Supply Chain: |

The price of commodities, in particular oil and gas (“O&G”) has a direct impact on the Products Business. The decline in O&G prices since 2014 with a partial recovery since 2016 has resulted in large scale reductions in capital and operational expenditures and seismic changes in the subsea market. This directly impacts on the Products Business by reducing the quantity of sales and rentals into O&G and related markets. O&G has remained very competitive and customers are increasingly seeking significant discounts to place orders. Around 5% of the Marine Technology Business revenues emanates from this sector. Historically, and prior to the price downturn, the vast majority of our revenues were generated from the O&G sector.

Our technology is based on electronics that are designed and manufactured to our specification exclusively for us. These electronic components are costly. Advancement in technology may make these specialized components or circuits obsolete. Reengineering these key components could result in significant capital expenditure and also may cripple the production of our products since quick replacements cannot be found.

| F. | Government Spending for Defense: |

We are dependent on the timely allocation of funds to defense procurement by governments in the United States and the United Kingdom. A large part of our revenues in the Services Segment derives from government funding in the defense sector. In general, where there is a change of government, spending priorities may change from those priorities of the previous Administration. This may adversely impact on our revenues. Since the US Government is due to change in January 2021, this introduces a number of uncertainties including the new Government’s defense priorities and its ability to find consensus in the Senate on the Defense Budget. There is therefore a high probability that this will have an adverse impact on the order take of the Services Business in the 2021 calendar year.

| G. | Resourcing Levels |

Due to the fact that in relative terms we are a small business, we are hindered in our ability to compete for certain specialized electronic engineering skills as our remuneration package is not as competitive as those offered by bigger companies. This is further compounded by the UK leaving the European Union which now restricts our ability to recruit outside of the UK. We are also currently suffering from acute shortage of software resources which could hamper our ability to support our products and therefore impact on revenues and growth plans.

| 24 |

| H. | Investments: |

We lack the financial resources to advance our flagship technology at the commercially appropriate pace required to capture new markets and increase our sales which could facilitate new entrants to the market. For example, Teledyne Technologies Incorporated, a multi-billion company, has in recent years acquired a number of subsea companies that may speed up their entry into our market.

In relative terms, the Company has limited external sources of capital available, and as such is reliant upon its ability to sell its products and services to provide sufficient working capital for its operations and obligations. Notwithstanding, on or around November 27, 2019 the Company secured a $4 million Revolving Credit Line from HSBC NA, its current bankers which can be used for working capital purposes, including expansion activities as required.

| I. | Technological Advancement: |

A significant part of our growth strategy is predicated on our flagship real time volumetric imaging sonar technology. The technology space is inherently uncertain due to the fast pace of innovations and therefore we can give no assurance that we can maintain our leading position in the real time volumetric imaging sonar market or that innovations in other areas may not surpass our unique capability that we currently supply to the subsea market. An example of new technology entering the subsea market is LIDAR technology. However, unlike our sonar technology, LIDAR technology cannot be employed in zero visibility conditions and cannot generate a volume pulse or image moving objects.

Critical Accounting Policies and Estimates

This discussion and analysis of our financial condition and results of operations is based on our consolidated financial statements that have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The preparation of financial statements in conformity with US GAAP requires our management to make estimates and assumptions that affect the reported values of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported levels of revenue and expenses during the reporting period. Actual results could materially differ from those estimates.

Below is a discussion of accounting policies that we consider critical to an understanding of our financial condition and operating results and that may require complex judgment in their application or require estimates about matters which are inherently uncertain. A discussion of our significant accounting policies, including further discussion of the accounting policies described below, can be found in Note 2, “Summary of Accounting Policies” of our Consolidated Financial Statements.

Revenue Recognition

All of our revenues are earned under formal contracts with our customers and are derived from both sales and rental of underwater technologies and equipment for imaging, mapping, defense and survey applications and from the engineering services that we provide. Our contracts do not include the possibility for additional contingent consideration so that our determination of the contract price does not involve having to consider potential variable additional consideration. Our product sales do not include a right of return by the customer.